The Lloyd’s List shipping decarbonisation survey finds out what the industry’s most important stakeholders see in their future and what they are doing in the present.

The first shipping decarbonisation survey, a collaboration between Lloyd’s List and Lloyd’s Register, asks owners and non-owners how they see decarbonisation working out, who will drive it, what impact it will have and where they stand today.

Regulatory action is now one of the most important factors for shipping’s decarbonisation prospects, according to the first ever Lloyd’s List shipping decarbonisation survey.

More than a quarter of the owners, operators and managers that responded to the survey identified decarbonisation as the greatest challenge to the shipping industry, followed by the impact of the ongoing coronavirus backdrop.

Conducted between mid-October and mid-December 2020, the survey amassed insights from shipping companies, charterers, investors, government representatives, non-governmental organisations and other stakeholders.

The pivotal role of policymakers and regulators in materialising shipping’s decarbonisation ambitions has been apparent for some while, but the findings of the survey illuminate just how significant it has become.

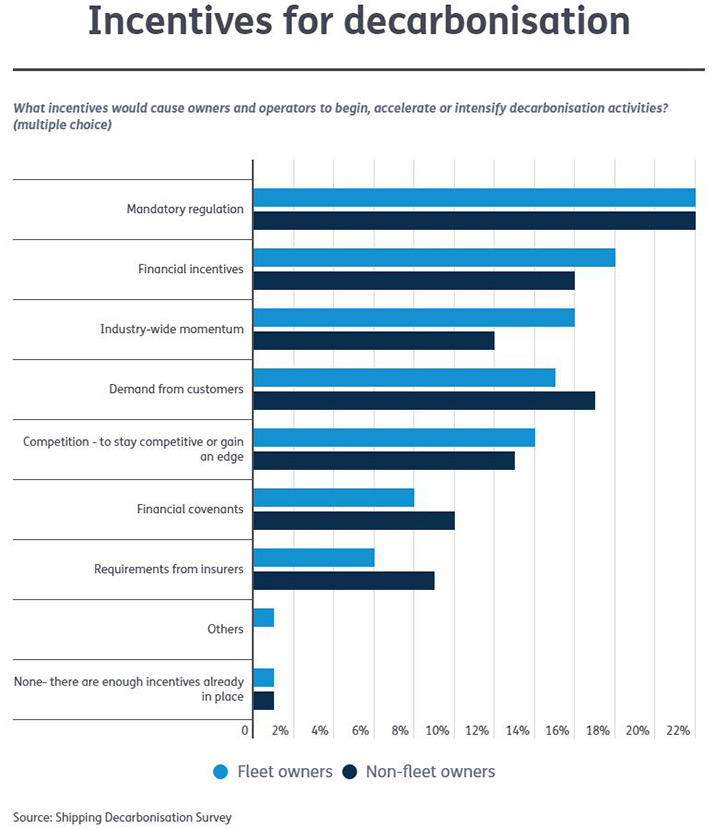

Respondents across the board saw the “lack of clear, detailed regulations” as the single greatest potential barrier to decarbonisation, while the possible lack of proven viable decarbonisation solutions was also among the biggest impediments.

Fleet owners identified the International Maritime Organization and regional regulators as the two biggest pressure drivers for the decarbonisation of their operations. Investors were the third largest pressure force.

Along the same lines, both fleet owners and non-owners see mandatory regulations as the single biggest motivating factor for future action on decarbonisation, with financial incentives following as a close second.

The position reflects the cornerstone of decarbonisation success, which is that regulatory certainty will help boost investment in the development and adoption of cleaner technologies.

The survey’s results come ahead of a defining year in decarbonisation regulation and climate politics for shipping that could see regional policies outpace progress made on the international level.

In about six months’ time, the European Commission will unveil its plan for adding maritime to the Emissions Trading System, the EU’s carbon trading market. Though subject to political negotiations, it should result in a new market-based measure regional measure for shipping, a prospect widely loathed by the industry that wants global action taken through the IMO.

This year, the IMO is also set to finalise short-term operational and technical efficiency requirements that will also affect the existing fleet, where regulations thus far have focused on newbuildings.

These IMO measures are the early implementation of the its overarching commitments to slash shipping’s total annual greenhouse gas emissions by at least 50% by 2050 compared with 2008, while reducing the fleet’s carbon intensity by at least 40% by 2030 and aim for 70% by 2050.

Nascent action and ambition are already affecting business decisions. While 23% of the fleet owner respondents said the industry’s decarbonisation ambitions have had no impact on their fleet investment plan, the remaining 77% said they have had to take relevant action, ranging from changes to their existing fleet to order delays and cancellations.

Owners said they are currently relying mostly on fuel optimisation technologies, coatings and slow steaming to improve their ships’ energy efficiency.

The fleet’s fuel composition will change drastically over the next 10 to 30 years. Some 20% of fleet owners believe their ships will be running on liquefied natural gas and as many anticipate they will use current marine fuels combined with carbon offsetting in 2030.

But those rates dwindle down to 5% for LNG and 7% for the carbon offsetting combination in 2050.

Meanwhile, the share of those owners expecting to be running ships on hydrogen and ammonia grew from 8% and 7% respectively in 2030 to 19% and 20% in 2050.

This article was originally published by Lloyd's List.