The 137,000 m3 Galea, originally built for Shell Singapore, is now being converted into a floating storage and regasification unit (FSRU) that will transform the energy backdrop on the island of Cyprus when the unit is deployed later this year, or early next. Work is in progress at Cosco Shipping Heavy Industry in Shanghai.

The ship’s conversion is central to a deal, partly funded by the European Union, which should slash the island’s cost of electricity, reduce carbon emissions, improve air quality and provide energy security for more than two decades. Ultimately, it could provide the path to a low-carbon or even zero-carbon energy future. LR has been closely involved in the project since it first became a possibility in 2017. Since then, it has involved bringing together Cygas, the Natural Gas Public Company of Cyprus, China Petroleum Pipeline Engineering – which will own the FSRU – and the Cyprus Electricity Authority in Vassilikos.

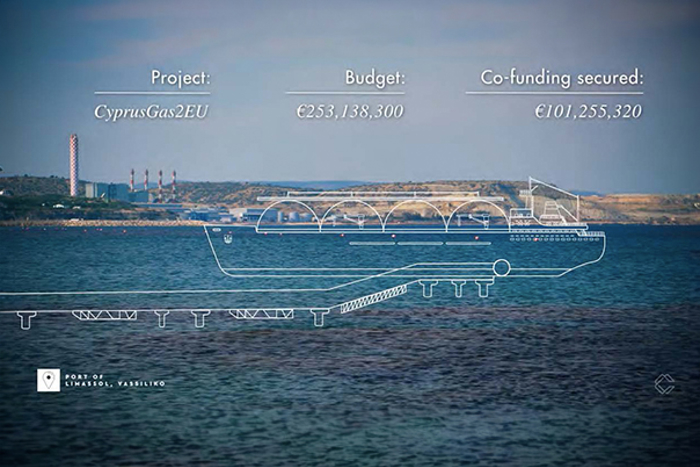

Major funding success

The development is the most expensive infrastructure project ever undertaken by the Cyprus Government. Through the project vehicle, CYnergy, which was established by the Government, LR and a team of consultants including experts from the classification society, a total budget of about €290 million was agreed for the investment, of which the European Union is funding €101 million through its Connecting Europe Facility. The converted FSRU will be moored alongside a purpose-built jetty at the gas import terminal in Vassilikos. From there, gas will be piped to shoreside LNG infrastructure with links to the country’s energy grid until 2046.

Today’s very high electricity costs for the island’s consumers – both private and industrial – are likely to fall sharply as a result of the energy initiative, with a notable impact on the local economy, the geopolitical stance of the island in the Eastern Mediterranean region and its appeal of the island as a business location. It will also facilitate a new energy hub for industries including shoreside transport, shipping and logistics. Cygas Chairman, De Symeon Kassianides, commented on the LR’s long commitment and support for the project which, he said, was instrumental in raising the necessary finance. “LR’s contribution to the CYnergy project proved essential to its success,” he said. “Thanks to their efficient dealing with tight schedules and requirements, the project was instrumental in enabling DEFA [the country’s Natural Gas Company] to secure €101 million of EU funding for the subsequent implementation phase.”

LR’s Global Gas Segment Manager, Panayiotis Mitrou, has been closely involved in the project since the start. He sees a model that could be adopted in many regions which lack indigenous energy resources and are exposed to wide fluctuations in energy prices. He points to the global abundance of gas, rapidly increasing volumes shipped by sea, a series of new long-haul and small-scale trades, and its low cost.

Too much gas?

He highlights the new LNG trains coming on stream in locations including Australia, Qatar, Russia and the US. Despite the pandemic, more front-end engineering designs get the go-ahead and the number of final investment decisions continues to rise. Ultimately, without more consumers, the world could have too much gas.

“All this gas needs to be channelled to markets,” he says. “And we see growing interest in many countries in using FSRUs for LNG imports."

Mitrou highlights another project in which LR is currently involved in Greece. The country’s Copelouzos group has set up the company, Gastrade, to develop and operate a new FSRU at Alexandroupoli in the north. The unit is likely to be built in China. The Greek gas grid operator, DESFA, has recently become a Gastrade shareholder as well as Bulgaria’s Bulgartransgaz, which has taken a 20% stake in exchange for a gas offtake commitment when the newbuild unit is commissioned.

Not the final answer

Although Mitrou is a staunch advocate of LNG as an energy source, he is also well-aware that the fuel is not the final answer to the world’s decarbonisation goals because it is still a hydrocarbon. Nevertheless, he insists that it is an essential transition fuel, and has a series of benefits that are available immediately today.

In the longer term, he points out, the fuel has the potential to provide many further carbon-reducing options. Green liquefaction is one example, this involves the liquefaction of gas using renewable electricity but will require the integration of the power generation and LNG sectors, which traditionally work quite separately. It has the potential to reduce significantly the well-to-wake emissions profile of the LNG that is used today. Ultimately, as new fuel technologies develop, Mitrou believes that it will become possible to use LNG as a hydrogen carrier by separating the carbon and hydrogen atoms, enabling the use of hydrogen as a carbon-zero fuel. Much of the world’s LNG infrastructure which will exist by then, he suggests, can be developed and adapted for hydrogen fuel development.

"The oversupply of gas requires more entry points, and FSRUs provide a quick and cost-effective way of providing the infrastructure that is required. We see a substantial uptake in the FSRU sector."

LR blazes long trail in floating gas

LR’s track record in all aspects of LNG transport by sea, and more recently its production offshore, sets the classification society apart as a safety and assurance pioneer in the field. From the early days of containment system design and the cryogenic technology required to ship LNG at -162°C, to the very latest offshore production facilities to develop gas reserves in ultra-deep waters under the sea, LR has provided constant and reliable support for the sector.

The Brunei LNG plant, the first in the western Pacific, opened for business in 1973. By then, LR was already involved in the design and classification of the first four LNG carriers to service the plant – the so-called G-class of 77,731 m3 vessels built in France. The ss Gadinia loaded her first cargo there in 1973 and was deployed constantly over her 45-year life in the carriage of LNG from Brunei to Japan. She was only sold for recycling in 2018.

Over that ship’s lifetime and in the few years since her passing, the global LNG business has undergone an astonishing transition, enabling gas as a fuel to contribute nearly a quarter of the world’s primary energy requirements in 2019, according to the most recent issue of BP’s Statistical Review of World Energy. The Review also notes that LNG exports grew by their largest margin ever in that year, the latest for which comprehensive figures are available. Exports grew by 54 billion cubic metres, equivalent to an increase of 12.7%.

Today, LR has the largest share of LNG carriers in its class, with more than 160 vessels in total and over 50 carriers in the popular 170-180,000 m3 range, either in service or under construction. The class society has overseen the installation of more than 60 separate reliquefaction systems and has pioneered 20 major gas ‘firsts’ over the years.

LR has developed strong LNG sector links with South Korea where it has been involved in the construction of more than 120 newbuildings. The class society is currently overseeing the construction of 29 new LNG carriers, 24 of them at Hyundai Heavy Industries where it has classed 57 LNG tankers. The class society’s offshore and energy experts have also played an integral risk assessment and assurance role in construction of some of the most prominent LNG projects so far. And it has established an important lead in floating LNG, which is widely seen as a potentially faster and cheaper option to land-based plant in some locations.

LR has provided advisory, assurance and classification services for 11 floating LNG projects so far. They include the world’s largest offshore floating plant – the Shell Prelude production facility in Australian waters – and the Browse Basin project, also in Australia, a joint venture between the plant operator, Woodside Energy, Shell Australia, BP Developments Australia, Japan Australia LNG and PetroChina International Investment.

Meanwhile, LR’s team in South Korea is closely involved in the assurance and classification of the world’s first ultra-deep floating production facility at Samsung Heavy Industries’ Geoje Shipyard. ENI’s Coral South facility for deployment off the coast of Mozambique will harness gas reserves under the ocean bed in water depths of more than 2,000 metres. The hull was launched at the shipyard in January 2020 and is due to be commissioned in 2022. Recent developments have meant a new LNG focus for LR – this time in China. The classification society is involved in a project for a new FSRU to be located in northern Greece, as well as the Galea conversion for Cyprus.

LR’s Cyprus team

The classification society’s three-person team in Cyprus has its work cut out. The island is home to several large ship management companies, as well as owners, financiers and equipment companies. It is also one of Europe’s largest ship registries. Philip Hadjisoteriou is LR’s Business Development Manager there. He explains that the Cyprus team likes to adopt a personal approach which fits well with local culture and the working environment in Greece where the classification society has a larger set-up in Greece. Between them, the two teams aim to offer a one-to-one service to clients built on plenty of personal contact and the exchange of resources as required.

“We have a one-stop shop here is Cyprus,” Hadjisoteriou says, “with something for everyone – business, technical, operations and, recently, a growing number of remote survey requests. We have technical advisors on hand at all times.”

The Cyprus team is expecting an influx of extra work, as shipowners and managers address the IMO’s latest intentions for reducing emissions on existing ships. The energy efficiency existing ship index and the carbon intensity indicator will both need to be assessed for ships in service, with carbon-reducing measures, if necessary, likely to be required on the first renewal of a ship’s International Energy Efficiency Certificate after January 2023. To assist clients in meeting current and future environmental challenges, LR has recently opened a decarbonisation advisory centre in Athens, Greece.