The reduction of carbon and/or greenhouse gas emissions from ships is without doubt the biggest issue facing the maritime sector now and in the future. And when looked at through a wider lens, shipping is also challenged with environmental, social and (corporate) governance (ESG) issues more generally. As a firm with a large global practice dedicated to the maritime sector, Watson Farley & Williams (WFW) set out to discover whether the shipping industry, one with a reputation for being resistant to change, is alive to these issues and whether it possesses the collective will to seek to tackle them. And perhaps most importantly, the financial means to do so. WFW’s report, “The Sustainability Imperative; ESG – Reshaping the funding and governance of shipping” is based on data from a survey of 545 high-level executives from across the sector, with further input from 10 highly respected industry participants. The challenge is immense, so where to begin?

The first steps

If the first step towards solving a problem is realising you have a problem, the maritime sector is off to a good start. The WFW survey showed that decarbonisation is viewed as the main challenge facing the industry, well ahead of non-ESG factors. However, there is no consensus on how to meet environmental targets and the technological challenge is immense. Zero-carbon fuels already exist but not at the scale and cost to make them commercially viable. While some cleaner fuels such as LNG emit less carbon dioxide, they also emit other undesirable gases in greater volume. Other fuels are clean but their production is not, which merely shifts the carbon burden down the value chain.

"Uncertainty about the ultimate future energy source serves as a handbrake on investment in cleaner fuel-powered ships, with operators fearing they might make the wrong choice on a 20-30-year investment."

In the meantime, other carbon emission-mitigating technologies, such as better hull and powerplant designs, hardware retrofits and voyage optimisation software merely generate marginal improvements. As is often the case, it all comes back to money, as indicated by the WFW survey which showed that cost is the key driver behind a shipowner’s decision to invest in a new technology.

Going it alone, or strength in numbers?

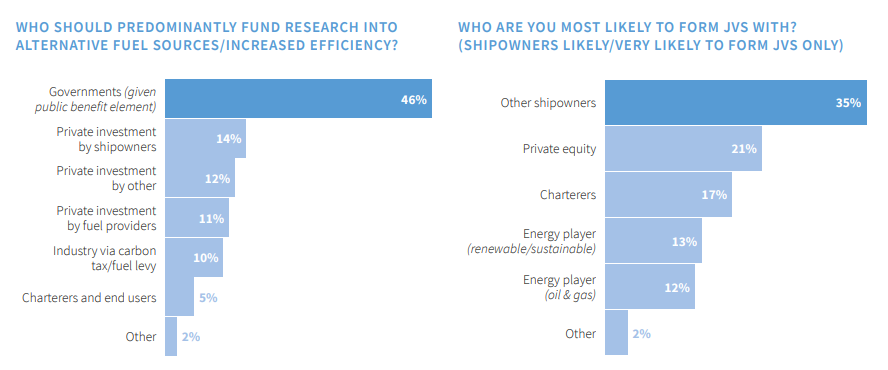

At the very heart of shipping’s decarbonisation challenge is the question of who will be the first to take on the risk of researching, developing and installing new technology. Many think that governments should take the lead in funding research, but taxpayer funding for cleaner shipping may be hard to justify given the supranational nature of the industry. Any such support may also prove a double-edged sword, coming with more binding obligations attached, possibly extending beyond merely environmental standards and into corporate governance.

One way to bridge the first-mover problem is through more collaboration and risk sharing. The WFW survey results suggest shipowners are prepared to cooperate with their peers (ahead of others) on such matters. Depending on your viewpoint, this can be seen as both conservative, unwilling to venture outside the industry to join forces with energy or technology companies, or progressive, willing to work with their competitors for the greater good. It’s clear that shipowners still value their independence, but the financial demands of clean technology could see them consolidate, give up equity or go public, all associated with better governance and financial reporting and more transparency. Vertical integration will also be required, as well as more cooperation between shipowners, charterers, end users, fuel companies, manufacturers and shipbuilders as well as regulators and governments. This is where we see a coming together of the environmental (E), social (S) and governance (G) elements.

Can environment be the engine that drives social and governance?

One driver towards better governance is attracting fresh capital to the sector. A majority of shipowners, charterers and financiers agree on the need to improve transparency to attract new investors. In concert with stronger environmental credentials, this is seen as key to accessing additional funding and the capital markets. Interestingly, we found shipowners view the social element of ESG as more important than the governance criteria, being significantly more concerned about crew welfare than financial reporting. This isn’t surprising when viewed through the prism of the COVID-19 pandemic. Interestingly, many in the industry believe the drive to sustainability will bring about changes in the shape, capital structure and financing of the sector, meaning shipping won’t be able to bring about significant environmental change without also addressing social and governance issues. Progress towards the IMO’s 2030 and 2050 targets will surely be easier if this virtuous circle, of the ‘E’ being one of the biggest drivers of improvements in the ‘S’ and ‘G’ in shipping, becomes a reality.

We have already seen significant voluntary initiatives, gathering momentum involving collaboration and alliances between various stakeholders in the industry such as the Getting to Zero Coalition, the Poseidon Principles and the Sea Cargo Charter. These voluntary initiatives in conjunction with recent developments on the regulatory side, involving amendments to MARPOL through the creation of an Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII), as well as the EU’s Scope 3 Emissions regulations, give an indication of the direction in which the industry is travelling, with this process expected by many to accelerate in the coming years. Many would argue that if asked the same question about ESG in shipping five years ago the answer would have been very different. Such a rapid evolution in the collective mindset of the industry gives hope that shipping can indeed rise to these considerable challenges and ensure itself an environmentally and financially sustainable future.