With two distinct fuel paths emerging, hydrogen-based fuels and biofuels, the LR Maritime Decarbonisation Hub’s report, ‘The Future of Maritime Fuels’ finds that regardless of which future will unfold, there is a significant need to scale production for each of the zero and near-zero emission fuels.

The shipping demand for clean fuels is potentially considerable compared to other sectors. This underscores the industry’s pivotal role in driving clean fuel adoption while grappling with unique challenges in balancing demand, supply, and investment in alternative fuel pathways.

The analysis of the expected supply and demand of the most promising clean fuels also highlights the need for fuel procurement practices and strategies to fundamentally change.

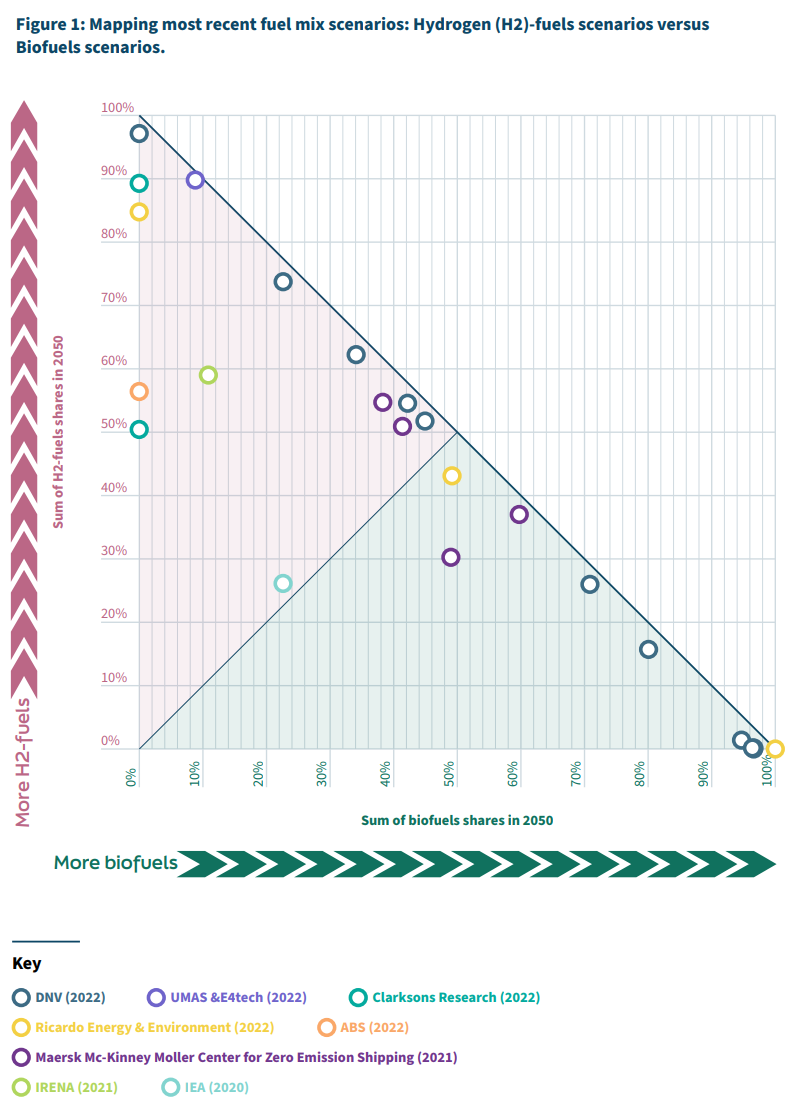

Covering a wide range of fuel mix projections, the report identifies two contrasting paths– hydrogen-based fuels scenarios and biofuel scenarios with several points of agreement and uncertainties. For example, e-ammonia and liquefied bio-methane could become the dominant fuels to take shipping towards the net-zero pathway by 2050. Whereas, methanol is projected to have a lower market share of the shipping fuels market than ammonia and bio-methane, which runs counter to current trend of ordering dual-fuel methanol vessels in today’s shipping market.

Consolidating future fuel mix projections

The 80th session of the International Maritime Organization (IMO) Marine Environment Protection Committee (MEPC 80) set new greenhouse gas (GHG) emissions reduction goals for the shipping industry, which will lead the sector to switch from conventional fuels to zero or near zero GHG fuels by 2050.

However, as of now, the path towards achieving zero-emission shipping remains uncertain, as the industry lacks a clear consensus on the future fuel mix. Various projections exist regarding what this mix might entail, 25 such projections were reviewed in this report from nine different sources. The aim of the review was to consolidate these projections, providing a comprehensive overview of the range and means of each fuel.

Speaking to Horizons, Dr Charlie McKinlay, Decarbonisation Analyst from the Maritime Decarbonisation Hub, said: “Rather than adding another projection to the mix, we thought that we would bring them all together to better understand where there is consensus and where there isn’t.”

McKinlay further explained: “Many stakeholders might not have the time to sift through report after report, so the concept was to deliver a one-stop shop for future fuel mix projections.”

The hydrogen-based fuels scenarios are based on synthetically produced fuels that require hydrogen as feedstock, which could be produced from renewable energy sources such as wind and solar power. While hydrogen-based fuels have the potential to deliver zero-emission propulsion, production technology for such fuels requires significant investment to scale up. The report therefore identifies the scale of the robust infrastructure needed to support the production, storage, and transportation of hydrogen-based fuels.

The biofuels scenarios are based on the use of fuels that are derived from organic matter such as crops and waste. While biofuels have the potential to be a low-carbon fuel, there are concerns about the sustainability and scalability of biofuels production, as well as indirect impacts such as food security.

Avenues for further exploration

Essential is the industry’s future capacity to scale production of each of the zero or near zero fuels to meet the expected demands from a range of potential end-users. These demand projections can materialise with effective policies. Investors in fuel supply need to consider the maritime fuel demand required to unlock the necessary scaling up of the infrastructure.

McKinlay added: “It is not immediately obvious whether demand from other sectors for the same fuels should be viewed as an opportunity or a threat. For fuels that are easier to scale, such as hydrogen or ammonia, then a strong demand signal can really incentivise the scale up of production. Whereas, for fuels that rely on limited natural resources, competition can limit availability and therefore drive the prices up.”

These contrasting effects may depend on the relative willingness to pay the premium across potential multiple end-users. The shipping industry may benefit from leveraging the dual role as both a transporter and user of clean energy sources.

Next steps for the industry entail further assessments that take into account a multi-sector perspective. The shipping industry can play a crucial role in developing the economies of scale required for clean energy, which will help unlock broader investment cases at the company, national and regional levels.