In November 2021, political leaders, investors and industry stakeholders gathered at COP26 in Glasgow with the same mission: to try and accelerate action towards the goals of the Paris Agreement. In other words, continue the search for zero-carbon alternatives to today’s fossil fuels. At TerraPraxis, we gathered key industry stakeholders, representing several trillion dollars in potential market demand, who revealed new near-term climate-scale strategies to compete on price and performance with fossils fuels. This then saw customers, investors and political leaders announce strategies to accelerate the affordable repowering of two Terawatts of coal and delivery of 100 million barrels per day of carbon neutral liquid fuels. These large-scale solutions repurpose trillions of dollars of existing infrastructure, known to supply reliable energy but without the emissions, and thus advance groundbreaking progress towards becoming net-zero by 2050.

However, despite the progress already made in driving down emissions in the power sector, projections show that fossil fuels will continue to supply the bulk of global energy by mid-century, and coincides with the high-risk 4°C trajectory, in which substantial areas of the planet will become uninhabitable. Meanwhile, 840 million people have no access to electricity today, and nearly 3 billion people depend on inefficient and highly polluting cooking systems, resulting in nearly 4 million premature deaths each year, according to Sustainable Energy For All (2021). To address these multiple crises, the supply chain will require the extensive deployment of electrification, efficiency, renewables, and other clean technologies, and in turn need a significant growth in energy access in global mitigation strategies.

Nuclear energy has been identified as being a necessary component of climate mitigation roadmaps by international institutions, such as the Intergovernmental Panel on Climate Change, International Energy Agency and European Commission, but has also been dismissed as being too expensive and slow.

While, nuclear power has its benefits and drawbacks, there is much we can learn from the renewables industry and its success as a template for broader and deeper emissions reductions. And there is the potential to transform today’s costly and cumbersome projects to modernised, manufactured products using nuclear technology which can be achieved by looking to other large-scale, high-productivity industries, such as shipping and aviation where innovative delivery models for “designed-for-purpose” facilities built by shipyards can quickly achieve significantly lower costs and large-scale deployment of clean technologies.

In this article, we look at the Terawatt-scale opportunity for advanced reactors, also referred to as ‘advanced heat sources’, which can contribute towards very low cost hydrogen and synthetic fuels production to address hard-to-abate sectors, including aviation and shipping, as well as the cement production industry.

The opportunity

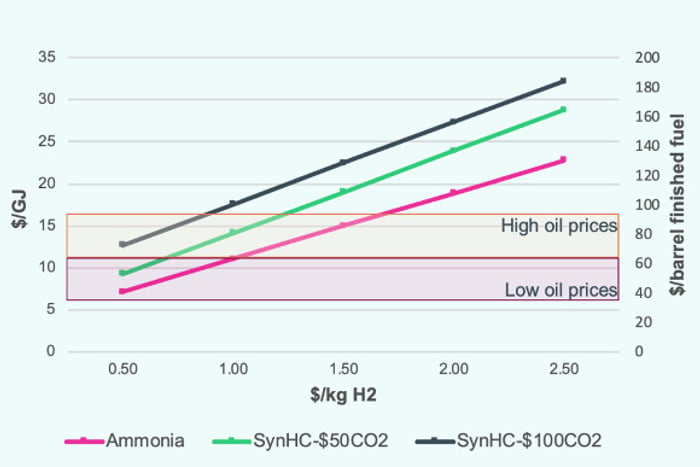

Large-scale, low-cost clean hydrogen could enable the decarbonisation of different industries, such as aviation and shipping, as well as the cement production industry, if these hydrogen-enabled fuels are competitive with cheap oil (see Figure 1). If low-cost hydrogen, below USD $1/kg, can be produced it could enable large-scale production of carbon neutral fuels, from Jet A fuel for the aviation industry, to ammonia which could replace bunker fuel for global shipping, and peaker-gas plants, as well as others. Yet, for advanced heat sources to play a role in driving a significant increase in low-cost clean hydrogen production we will need to see a transformation in project delivery and deployment models that can scale up and deliver low cost clean heat, fuels and power. This in turn will require the same intensity of focus on cost reduction, performance improvements and deployment rates that have enabled renewables to begin transforming the global energy system.

The role of shipyards

Steep, near-term cost reduction can be achieved through high-productivity manufacturing environments, such as shipyards. As many will know, the world’s shipbuilders and shipyards are known to be masters of cost, scale, and engineering integration, and already possess extensive manufacturing capacity, which can potentially produce designed-for-purpose hydrogen production facilities. In addition to this, shipyards are consistently accurate when it comes to costing and scheduling, and deliver complex assets on a regular basis, from ships to vast offshore units for oil & gas production, all of which are built to Rules and requirements set out by class societies, such as LR, supporting the safe design, construction and operation of each asset.

Fuel production

The production of fuels, globally transportable commodities, can enable a new business model for nuclear energy. As the product changes from local electricity to global fuels deliveries, the siting and scale of operations are transformed. Offshore deployment increases siting opportunities and reduces costs, further enabling global-scale production of low-cost synthetic fuels in the 2030s and beyond.

So, what could this look like in reality?

At LucidCataylst, we’ve developed two conceptual drawings of designed-for-purpose hydrogen production facilities which provide an idea of what these assets could look like in the future (as seen in Figures 2 and 3). The FPSO featured in Figure 2 has the potential to produce multiple products, including hydrogen, power, ammonia, and desalination, seen moored close to shore, with pipelines and underwater transmission cables sending products to shore, and Figure 3 represents an platform that can produce ammonia.

Demand to increase

Shipping is not alone in its search for low carbon fuels. With commercial air miles traveled expected to nearly triple by 2050 from 2020, the aviation industry also seeks an alternative to Jet A fuel. And the vast amount of arable land required to produce biofuel alternatives for aviation makes such a solution even more challenging. So, going forward, demand for cleaner air travel experiences could represent a major opportunity for producers of cost-competitive, carbon-neutral synfuels, including the production of cost-competitive Jet A (see Figure 4). LucidCatalyst’s latest report, commissioned by the Electric Power Research Institute (EPRI) Rethinking Deployment Scenarios to Enable Large-Scale, Demand-Driven Non-Electricity Markets for Advanced Reactors (December 2021) describes the techno-economic case for these three production platforms in more detail.

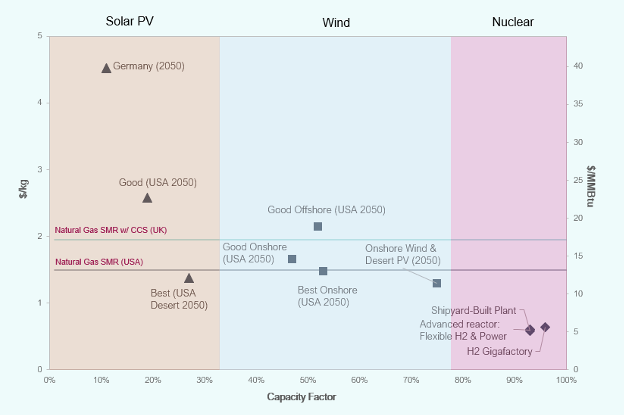

Global-scale hydrogen-based synthetic fuel production could therefore be accomplished with shipyard-manufactured, sea-going production platforms akin to the large offshore production vessels currently used by the oil industry, enabling a path to ultra-low-cost hydrogen for less than $1/kg.

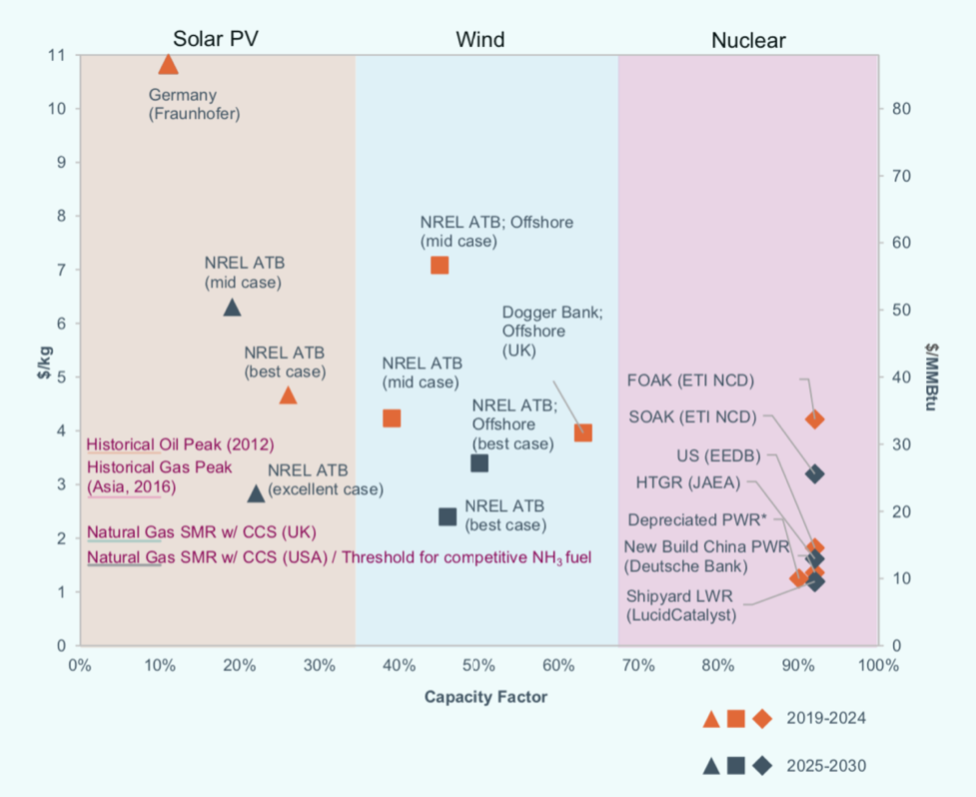

Figure 4. 2018-2030 Hydrogen production costs (data from multiple sources).

As shown in Figure 4, current projections for renewables-generated hydrogen do not expect to achieve these costs before 2050, this is likely because renewables are constrained by low-capacity factors even though we expect capital costs to continue to fall. Capacity factors for different technologies can drive cost outcomes, for example, renewable energy technologies usually generate for less than 50% of their nameplate capacity, whereas nuclear technologies generate for >90%.

Even current first-of-a-kind U.S. and EU conventional nuclear plants, not currently optimised for low-cost construction, can produce clean hydrogen at costs comparable to wind and solar resources with good capacity factors. Cost competitive, conventional nuclear plants, such as those being built in China today, could deliver clean hydrogen for below US $2/kg, and a new generation of advanced modular reactors could achieve US $0.90/kg before 2030. Furthermore, new delivery models can achieve hydrogen costs that enable cost-competitive synfuels at large scale as early as 2030, and achievable hydrogen production costs for 2030 – 2050 can be seen in Figure 5.

Figure 5. Hydrogen production costs 2030-2050 Source: LucidCatalyst.

Reality kicks in

The rapid achievement of low hydrogen costs through these innovative delivery models could accelerate deep decarbonisation across difficult-to-decarbonise sectors. By 2050, low-cost clean hydrogen could help avoid substantial global cumulative future carbon emissions from a large fraction of otherwise locked-in fossil fuels. Nevertheless, achieving the extent of decarbonisation required within thirty years will be a Herculean effort. Major constraints, including the extent of capital available for investment in new infrastructure, need to be considered. Although it’s worth nothing that such innovations would require a lower investment than would otherwise be required to replace the oil and gas flows in shipping and aviation.

Using these delivery models, the three-decade transition from 100 million barrels of oil consumed per day today to an equivalent flow of clean substitute fuels can be achieved at a much lower cost. For example, instead of US $25 trillion required to maintain oil flows until 2050, the clean energy substitute fuels are predicted to cost US $17 trillion. This contrasts further with the US $70 trillion for a renewables-only strategy (using projected costs for 2040).

So, is this scale and rate of deployment achievable in the real world?

The industry delivering the transition from oil and gas to clean synthetic fuels would need to deploy 14,000 platforms in the 30 years between now and 2050. This equates to annual additions of more than the current global nuclear fleet capacity — so, approximately 560 production platforms need to be developed/introduced each year from 2025 to 2050. In terms of the shipbuilding market, the world’s shipyards currently produce between 1,500 and 3,500 ships per year and are operating at 50% capacity. In addition to utilising excess capacity, we would also need to see the shipyard manufacturing capacity currently dedicated to oil and gas infrastructure reallocated for synthetic fuels production platforms. The substantial consolidation of shipyard capacity experienced over the last five years will also have an impact on the rate of deployment and scale, with findings from LucidCatalyst suggesting that the full substitution of the oil and gas industry by clean synthetic fuels would require the dedicated production of 64 large shipyards.