Authored by, Alfred Hartmann, Chairman, Hartmann AG and President of the German Shipowners’ Association.

The 150th anniversary of Lloyd’s Register in Germany offers a good opportunity to take a look at the state of the German shipping sector and the biggest challenges it is currently facing.

International seaborne trade plays a key role for Germany – not least because Germany continues to be one of the world’s most important shipping hubs, however, this status is under intense competitive pressure. It is therefore crucial for us to continue to strengthen and expand our position.

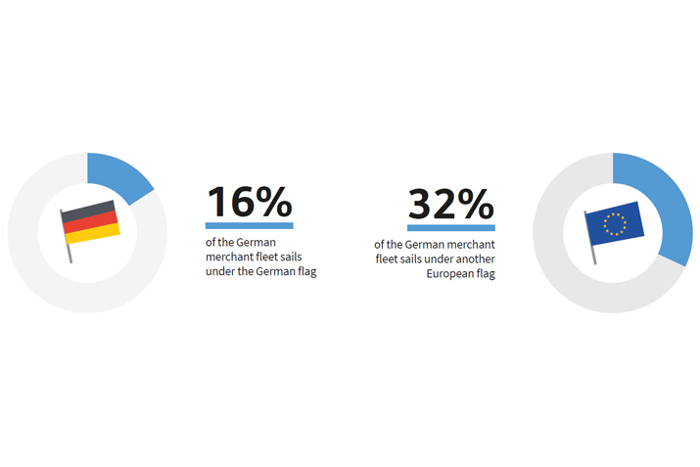

First, the facts: Germany is home to the world’s fifth-largest merchant fleet, with around 53 million gross tonnage, and its fleet of container ships is the second largest in the world. Compared with other shipping nations, Germany also occupies a leading position in the bulk carrier segment. Around 16% of the German merchant fleet sails under the German flag, while another 32% sails under a European flag.

Shipping is and will remain a crucial mode of transport linking Germany with markets around the world. 60% of the goods exported from Germany continue to be transported by ships. But for the country to be able to export first-class products across the world, one of the things it first has to have are raw materials and intermediate products imported into Germany. And a sizeable share of these imports are also transported by sea. Especially throughout the pandemic, the special role that shipping plays in securing the supply chains for our industries and for provisioning the population is of paramount importance. Europe is growing as a “workbench”, and millions of jobs in Germany also depend on seamless global connections via merchant shipping.

Fleet size is also important for value creation in the downstream service sectors. German shipping companies are responsible for a total of around 480,000 jobs in Germany, with around 86,000 direct employees on land and at sea and an additional 48,000 jobs in ocean-going tourism. From the direct employees alone, almost 1.2 billion euros in taxes and social security contributions flow into the coffers of the state or social security funds. German shipping companies estimate that they collectively contribute more than 30 billion euros to value creation in Germany (plus 6.6 billion euros from cruises).

The COVID-19 pandemic has also presented shipping with unique challenges. It has highlighted just how important the work of seafarers is within the global supply chain. The extent to which the pandemic will impact the economic development of shipping will especially depend on the pandemic’s duration and the pace of economic recovery.

However, regardless of the further course of the pandemic, Germany must position itself even more competitively than before if it is to play a future role as a shipping nation. In this context, ship financing in Germany will be a crucial factor. For many years, access to financing options and the above-average availability of both equity and debt capital – especially for newbuildings – was a decisive advantage for Germany as a shipping hub. But those days are over. The average age of the commercial vessels in the hands of German shipowners is steadily increasing. Statutory climate-protection targets within the framework of the EU Green Deal or the Paris MoU will make it necessary to carry out retrofittings and conversions on the existing fleet and newbuildings. Due to these requirements, different solutions will have to be developed for the various trade lanes. Unfortunately, Germany has to date often lacked feasible solutions for securing the financings necessary for these retrofittings and conversions.

Regarding another important matter, in order to strengthen the German flag against its international competitors and thereby secure the country’s maritime expertise, we will have to put an even greater focus on training and employment. Thanks to the individual efforts of German shipping companies and of the German Shipowners’ Association (VDR), the German shipping sector has succeeded in safeguarding the training of the next generation on land and at sea to a large extent despite a crisis that has persisted for more than a decade. Following the years of unusual growth in the early 2000s – especially in the container shipping segment – and the subsequent decline, we now have a new normal: the German fleet is roughly as strong and in large parts even stronger than it was before this boom – and this also applies to the numbers of apprentices.

However, we must not slacken these efforts. The apprenticeship training ratio in shipping will remain at an above‑average level. In recent years, an average of roughly 1,200 junior seafarer staff in 75 companies were prepared for jobs on board ships in training programmes co‑financed by German shipping companies. And, as the VDR, we are happy to speak with all interested parties about how we can make training for land and sea positions so state-of-the-art and attractive to young people that we take the lead in the battle for talent.

About the Author

A trained shipbroker and shipping merchant, Alfred Hartmann graduated in Industrial Engineering & Management and attained the Deep Sea Master’s license for deep-sea vessels. Sailing in worldwide trades as Nautical Officer and Master, working as a newbuilding supervisor in Japan for two years and after that heading the personnel department of a German shipping company, in 1981 he founded Hartmann Reederei – today one of Germany’s largest shipping companies. In 2008, he assumed the position of Chairman of the Supervisory Board of Hartmann AG.