In an era of tightening environmental regulations, energy efficiency of marine assets is a growing concern for leading ship management companies. While operational measures to improve a ship’s Greenhouse Gas (GHG) footprint have been extensively applied due to their low to “no” cost, Energy-Saving Devices (ESDs) have until recently faced a lower adoption, weighed down by capital cost, long payback and negligible technology development.

However, maritime GHG pricing and taxation is now rewriting the ESD return on investment calculation. The EU Emissions Trading System (EU ETS) expanded to include shipping in 2024, supplemented with the introduction of FuelEU Maritime in 2025, and the impending global measures under the IMO's Net-Zero Framework (NZF) arrive in 2028. GHG emissions from ships now present a clear and rising operational cost for ships. This new reality adds a new dimension to the ESD business case, transforming payback times and net cash flow, making them not just more attractive but increasingly indispensable across the energy transition and beyond.

As fuel and GHG emission costs continue to climb, ESD integration has emerged as a strategic tool – not only to reduce a ship’s Operating Expense (OPEX), but also to hedge against future regulatory exposure. Ship owners and charterers must now reconsider the value of these technologies within a broader framework of compliance, competitiveness, and long-term resilience.

Let's explore the changing case for ESDs through a techno-economic business case that illustrates their attractiveness.

Setting the scene

For this example, the ESD case is considered for a 300k deadweight Very Large Crude Carrier (VLCC) with a 24 MW conventional main engine and auxiliary engine, and a planned end of life in 2036.

The annual fuel consumption for our VLCC is 15,200 t, with a mix of VLSFO and MDO. This gives us a total CO2,eq emissions of 56,670 t and a GHG intensity of 91.4 gCO2e/MJ.

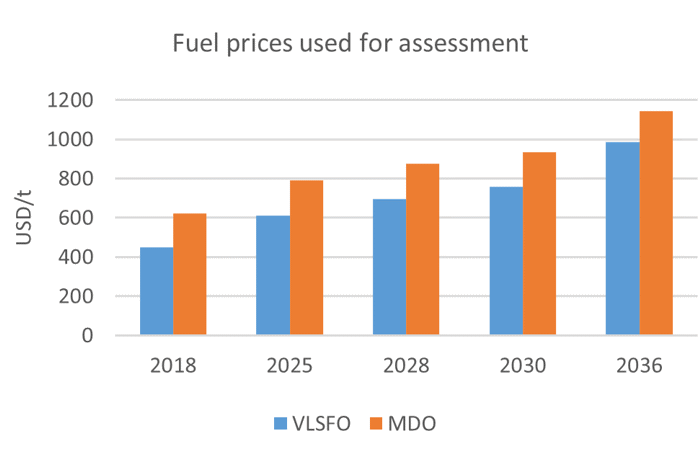

Fuel prices have always been volatile, shaped by global crude oil markets, geopolitical disruptions, refinery capacity, and regulatory shocks. Price swings of 30–50% within a year are common. This unpredictability makes it difficult to establish a representative annual price. The figure shows projected variations in fuel prices from 2018 to 2036 used for this example.

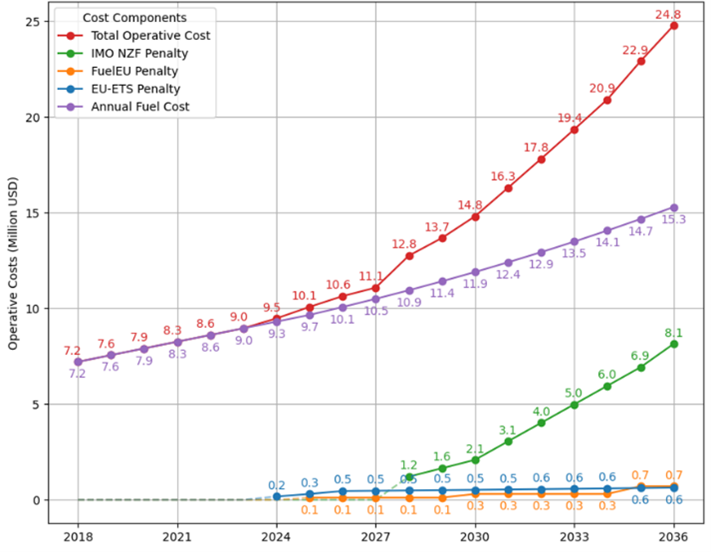

There are three carbon pricing and compliance instruments directly influencing the operational expenditure of the example VLCC: EU ETS, FuelEU, and IMO's Net-Zero Framework (expected to come into force in 2028).

These regulations are designed to drive the uptake of energy efficiency measures, alternative fuels, and emissions reduction solutions across the shipping value chain. So how will these compliance costs influence the VLCC operating costs?

The figure below shows forecast fuel costs and the GHG emissions compliance costs based on projected fuel price data and current knowledge on compliance costs from the EU and IMO.

Compliance costs for the VLCC start to have a significant effect in 2028 when the IMO Net-Zero Framework (NZF) emissions instrument comes into force. This cost is equal to more than half the fuel cost by 2036. EU regulations have a relatively small impact for this VLCC because she only uses 15% of her annual energy in European waters.

These would be the costs of doing nothing. How attractive are ESDs to reduce the cost of operations for this VLCC?

Retrofitting Energy Saving Devices

ESDs have always been part of the solution to fleet energy transition. However, widespread uptake of these technologies is frequently challenged by high capital expenditure and long payback times.

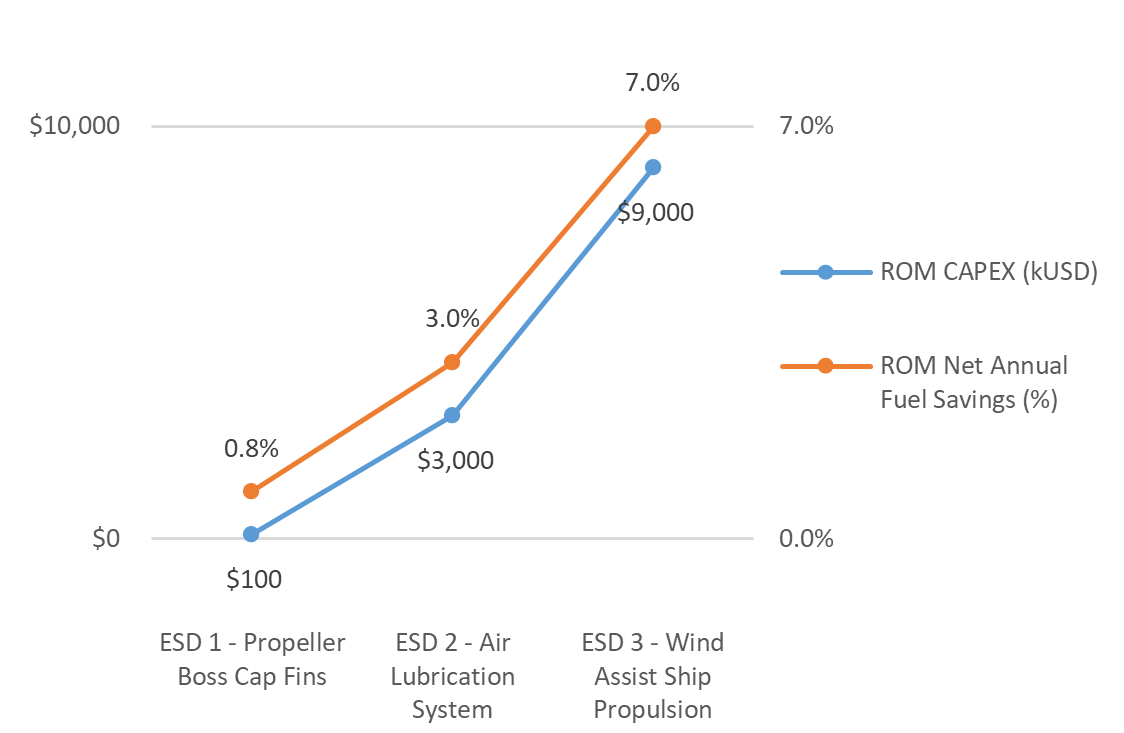

Is this still the case under new regulatory regimes? To answer this question, three different ESDs will be assessed using estimated capital expenditure (CAPEX) costs and net fuel savings: Propeller Boss Cap Fins (ESD1), Air Lubrication System (ESD2), and Wind Assist Ship Propulsion (ESD3).

The figure below shows indictive costs and performance data for these ESDs. Because there is great market variation in CAPEX and savings for ESDs, the numbers quoted here are for illustrative purposes only.

Retrofitting ESDs in 2018 – No Emissions Compliance Costs

The impact of each of these ESDs should be compared to a base-case, set at a point before these new regulations existed, in 2018.

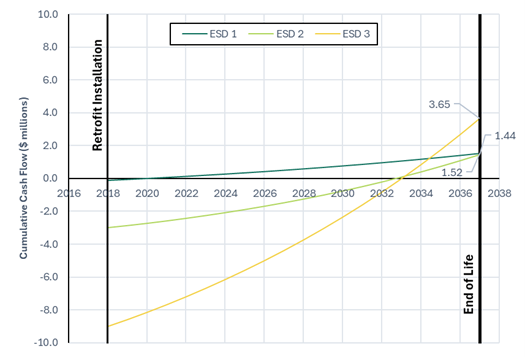

The figure below shows the cumulative cash flow for retrofitting each of the three ESDs in 2018 where no emissions compliance costs are applied for the remaining life of the vessel. ESD 3 will end with the highest cash flow at about $3.7 million or about 41% of its CAPEX, followed by ESD 1 at $1.5 million (1,500% of its CAPEX) and ESD 2 at $1.4 million (48% of its CAPEX).

Retrofitting ESDs in 2026 – Emissions Compliance Costs Applied

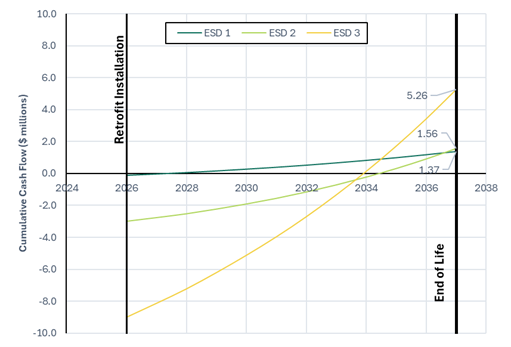

The cumulative cash flow calculations are now repeated for the scenario where the same ESDs are installed in 2026, when all the emissions compliance costs are in place.

For ESD 1, the payback time reduces to just over a year, while for ESDs 2 and 3, payback times reduce to about eight years. The emissions compliance costs have essentially halved the payback period for all ESD solutions.

Even though emissions compliance costs have made a significant impact on the investment business case for all ESDs, ESD 1 is the only clear solution to retrofit, given the example VLCC has only 10 years of life remaining.

However, looking at the cash flow trajectory, at the vessel’s end of life, ESD 3 results in a final positive cash flow of about $5.3 million (or 59% of the initial CAPEX), which is an attractive financial prospect for a long-term investment plan.

As market-based GHG measures gain momentum, the traditional benchmarks for assessing the value of energy efficiency investments quickly become outdated. While low-cost, high-return ESDs such as PBCFs remain obvious investment choices, the evolving regulatory landscape shifts the business case towards more capital-intensive technologies.

The timing of the retrofit, operational exposure to carbon pricing, and long-term cash flow potential all now play central roles in investment decisions. Shipowners and operators must move beyond static payback thresholds and adopt a more dynamic, life-cycle-oriented approach, to assess the return on investment. In this new context, efficiency is not just a cost-saving strategy. It is a hedge against regulatory tightening, a boost to asset value, and a key enabler of the maritime energy transition.

Get in touch with LR Advisory to find out the best time for you to invest in ESD technologies

For more information and analysis on ship retrofits, visit our Retrofit Research Programme