The IMO’s regulatory procedures, based on consensus among its membership of 175 nations, have at times been a source of frustration to proactive member countries during its 65-year history. But never before have the stakes been so high in the quest for an agreement on environmental protection. At stake, the possibility that the maritime industry loses its right to self-determination of decarbonisation targets.

The signs are clear to see. The European Union (EU) has already embarked on a regional shipping decarbonisation strategy, with complex new regulations including the EU Emissions Trading Scheme and the FuelEU Maritime initiative. They are part of the ‘Fit for 55’ strategy, in which the trading block has committed to reducing carbon emissions by 55% by 2030 compared with 1990 levels, and to achieving climate neutrality by 2050.

Anand Godavarthi, LR’s Regulatory Affairs Lead Specialist, points out that EU regulators are not critical of the IMO’s intentions per se, but they do want things to move more quickly. And, he says, so do some Asian countries including China, Japan and South Korea. These nations, and others including the US and the UK, want a credible and equitable decarbonisation strategy, ideally agreed at the IMO.

Godavarthi’s colleague, Jennifer Riley-James, Lead Regulatory Specialist, agrees, but warns that unless speed at the IMO picks up, what’s already happening in the EU could well be repeated elsewhere. This would result in a patchwork of similar, but varying, regulations around the globe, presenting shipowners and managers with an operational nightmare.

Meanwhile, for a significant number of nations in the developing world, the energy transition is a distant dream. They need whatever energy is available today – coal, oil, even charcoal – just to sustain life.

Possible silver lining

Riley-James believes that the potential nightmare could prove to be a blessing in disguise. If a series of separate schemes were set up, shipowners would face a huge monitoring, reporting and verification burden. It could even trigger a movement by ship operators to insist that compliance with different schemes, different places, and different timescales was simply unworkable in a commercial context. She does not rule out the possibility that this fragmented regulatory framework could prove to be just the catalyst that’s needed for a global regulation to be developed.

The whole GHG issue is fraught with challenges. It is scientifically complex, technically challenging in terms of fuel lifecycle assessments – well-to-tank, tank-to-wake – and highly political. Hydrocarbon energy producers do not necessarily share the same beliefs on GHG reduction as many of the world’s consumers.

There are practical issues too. One of these concerns the workability of a GHG Fuel Standard, a means of accurately assessing the global warming potential of fuels from source to use.

Meanwhile, as things stand, the IMO has no framework for collecting or managing the levies raised if a global emissions trading scheme were put in place. An international maritime fund, to gather taxes from carbon emissions and assign grants for qualifying research projects or investments in alternative fuel infrastructure, would need to be set up and managed. Some of the money would be channelled to developing countries to support their initiatives to ensure a fair and just energy transition. Potentially, billions of dollars are involved.

Practical risks

Mark Towl, LR’s Principal Specialist, Regulatory Risk, cites concerns over practical issues for shipowners and managers. He estimates that the four monitoring, reporting and verification systems either in place or currently under development in China, EU, UK and US together account for more than 80% of the world’s ships.

Ship operators face the possibility of four different sets of compliance issues, reporting systems, data collection, and verification, and ultimately probably more. Although the EU has indicated that it will withdraw its own scheme if the IMO can introduce one, Towl still believes that a global system, at least for the moment, is unlikely. Even then, it may not be in place until well into the next decade.

Towl points out another challenge. A large fund collected centrally and used to support developing countries and the development of new technologies to cut GHG emissions is one thing, but individual governments levying fines on polluters in different parts of the world could also become a reality. Where would that money go?

The traceability of tomorrow’s marine fuels presents another practical difficulty, Towl believes. While hydrocarbons can be traced and measured relatively easily from a well-to-wake perspective, classifying fuels of the future will be much more difficult.

Biological markers and comprehensive audits will be essential for assessing fuels such as e-hydrogen, and the rainbow of colours evident in tomorrow’s marine fuels. Supporting infrastructure will need to be created to undertake these assessments. There’s a huge amount of work to do to bring this transition to life, Towl declared.

His chief concern today is safety – of hydrogen, ammonia, methanol and nuclear. It will be essential, he insists, to have crews on board that are trained in these new fuels. At the moment, most ships’ crews typically handle two or three fuels which have broadly the same characteristics and safety profiles.

Tomorrow’s fuels will all behave very differently, and a Standards of Training, Certification, Watchkeeping Convention review is now under way. He sees the human element as the biggest potential risk facing shipping today. Most marine engineers spend years at college to handle one or two marine fuels. How long will the training be for handling a variety of fuels, he asks rhetorically.

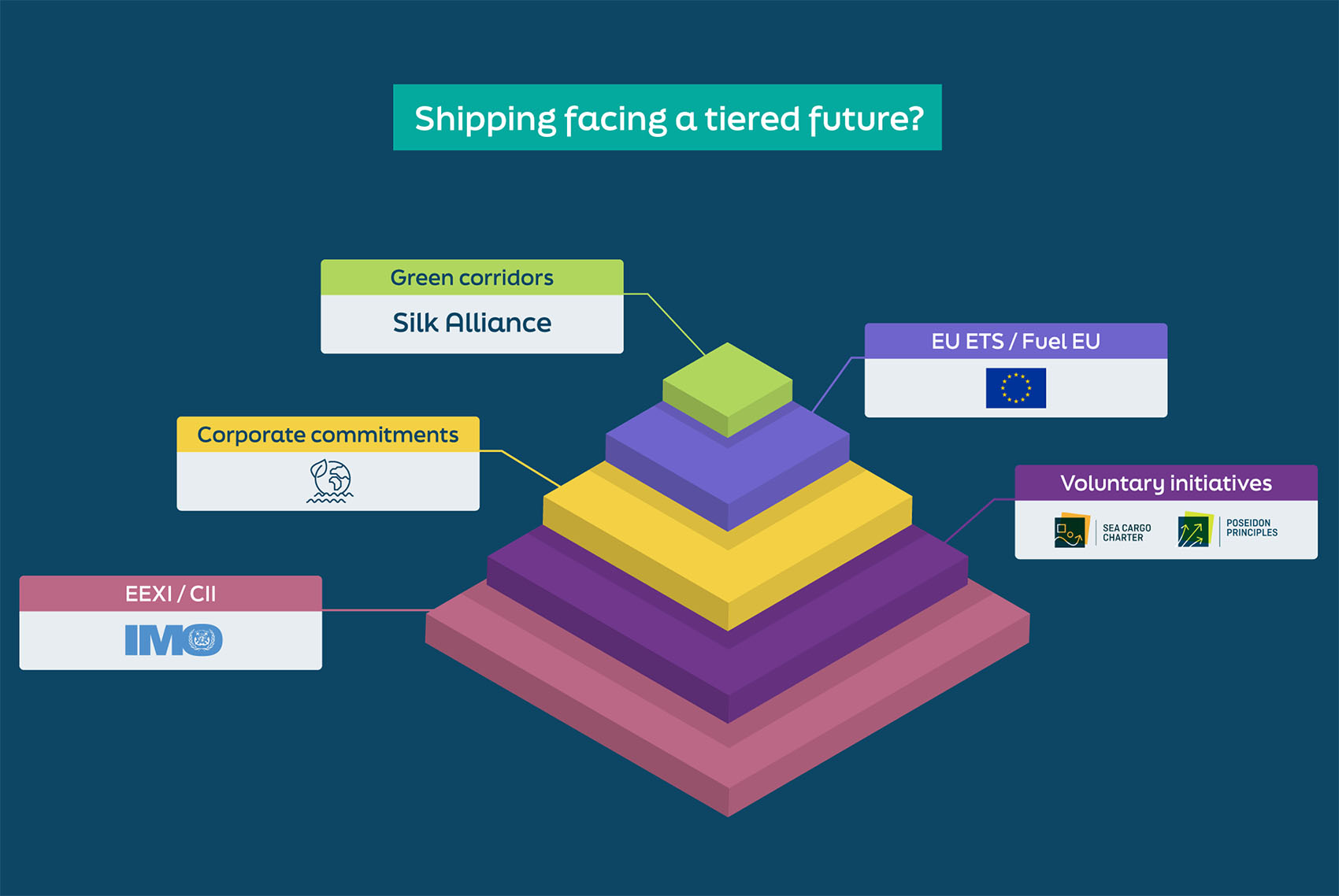

So what does all this mean for shipowners and operators today? James Frew is LR’s Business Consultancy Director and describes the challenges with the help of a pyramid-shaped chart (above) showing the tiered future of shipping. The IMO and its short-term efficiency measures (CII and EEXI) and revisions to its Initial GHG Strategy lie at the base. Above this are shipping’s voluntary initiatives such as the Sea Cargo Charter and the Poseidon Principles.

One level up is the growing number of corporate commitments as proactive shipowners and charterers adopt new fuels, undertake retrofits, install energy saving technologies such as wind propulsion, new propellers, more sophisticated hull coatings, and so on. Frew explains that in business terms, a proactive strategy works well for many companies which can demonstrate ambitious decarbonisation targets and robust ESG credentials.

Above this layer comes the EU Emissions Trading Scheme where penalties may be incurred for poor-performing assets. This level could include several new emissions trading schemes if MEPC 80 fails to make significant progress.

And, at the top, lie the Green Corridors which demonstrate real-life commitments by shipowners on certain routes, together with charterers, shippers, fuel providers, ports, and other stakeholders. These are the initiatives that demonstrate most clearly what can already be achieved today.

Frew sees clear signs of wide-ranging strategies among owners to the energy transition. At the base of the pyramid are owners and operators whose policies are based on minimum compliance; do as little as possible as late as possible. Without global regulatory enforcement, this last minute, minimum compliance strategy will not change. Regional enforcement strategies can prove to be effective, with the example of Australia which banned ships from entering ports without the appropriate hull cleaning in place, in an attempt to minimise the spread of invasive species. Similar enforcements are yet to be applied to ships with poor CII ratings but if enacted by port states could provide the impetus to drive higher compliance standards in the absence of a global enforcement regime. Towards the top, on the other hand, are premium operators. Their principal aim is to win the support of tier one charterers, earn better rates, and advance shipping’s decarbonisation journey as quickly as possible, potentially in collaborative and cost-sharing arrangements.

Until today, he suggests, owners have had the option to comply with IMO’s basic requirements, or to embrace energy-saving technologies and prepare for new fuels as they become available. The big question, though, in the run-up to MEPC 80, is whether the IMO’s July deliberations will force the whole industry to catch up with the leading players in the maritime energy transition. Their future may depend on industry-wide commitments to meaningful targets and measurable action.