With new fuels coming into use and many more commanding industry attentions, much of the work underway to integrate them into the future fleet is focused on newbuildings, but decarbonising existing vessels is a crucial element of the maritime energy transition.

Lloyd’s Register’s Engine Retrofit Report 2023: Applying alternative fuels to existing ships, weighs up many of the factors – both technical and economic – that must be considered when exploring whether an engine retrofit makes commercial sense as a solution to meeting future emissions targets.

In what will become an annual publication, this comprehensive study draws on LR’s expertise in alternative fuels and decarbonisation projects, which includes the world’s first methanol engine retrofit project on the ferry Stena Germanica in 2015. The report includes a short account of how that retrofit was conceived and the lessons it has delivered since but, for the most part, it covers three sectors: container ships, bulk carriers and tankers.

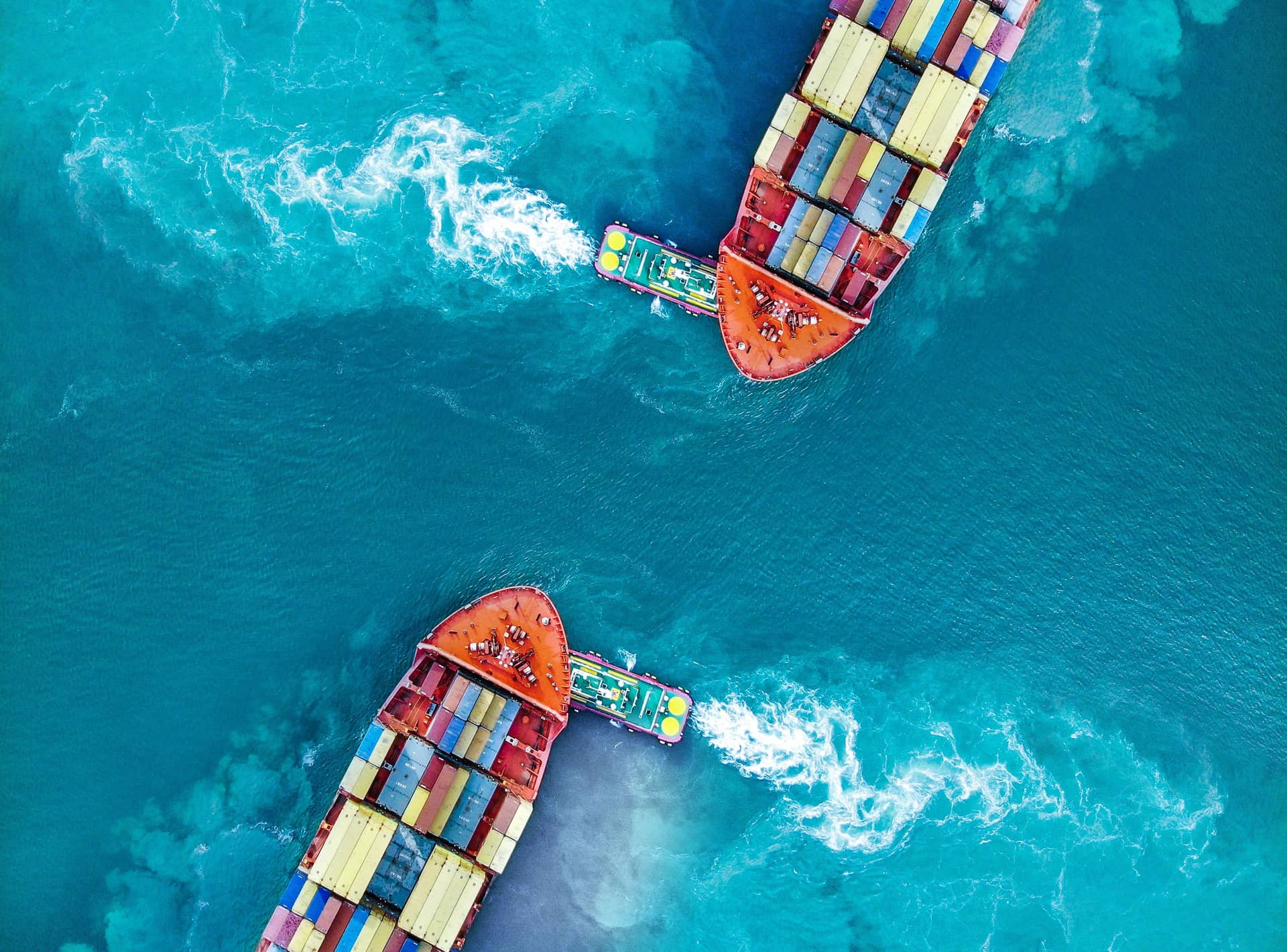

This focus is based on an assessment of the expected main market for engine retrofits in which LR’s modelling found a potential market of 9,000-12,900 large merchant vessels that could consider engine retrofits to decarbonise by 2050. From this group, a vessel population where retrofit uptake could be accurately analysed was identified, which includes only container ships of 8,000+ TEU, tankers of 50,000+ DWT and bulk carriers of 150,000+ DWT.

But speaking to Horizons, LR’s Global Containerships Segment Director Nick Gross said that such a retrofit covers much more than the engine, making the task a ‘vessel retrofit’, since so many ship systems are affected. So, when LR looks at a particular vessel or class, it works with its owner and probably its designer and engine OEM to conduct a wide-ranging hazard identification (HAZID) workshop to plan the scope of work required.

Of the three ship types identified in the review, container shipping spearheads energy transition investments, Gross said. Some box ships already use LNG while Maersk’s latest LR-classed newbuilding – the Maersk Laura loaded its first cargo in China during its delivery voyage to Copenhagen. Maersk is also planning to conduct the first dual-fuel methanol containership retrofit next year.

Gross suggested two drivers for his sector’s leading role: its liner-based structure and consumer demand. Its fixed-port rotations and fast-paced operations, make infrastructure investments and emission-saving opportunities more attractive than in the less-predictable and lower-powered tanker and bulker trades. Alongside that, charterers and their large retail customers are closer to end-consumers than in other sectors, raising ESG (environment, social and governance) policies up the list of priorities.

As a result, interest in retrofitting containerships for new fuels is growing, Gross said, and IMO’s revised GHG strategy, agreed at MEPC 80 in July, puts pressure on the existing fleet to consider its options. The strategy now aims to reach net-zero emissions “close to 2050”, which requires a commitment to ensure an uptake of alternative zero- and near-zero GHG fuels by 2030. This will require a significant proportion of the fleet to retrofit, Gross said.

This tight schedule is reflected in a change of emphasis in the enquiries LR receives from clients. Since about a year ago, requests have been received for engineering readiness studies, joint development projects and investigations into future fuels’ economic feasibility and availability. More recently, enquiries are increasingly about tangible projects and specific fuels.

Gross stressed that it is important for those considering engine retrofits to decide on their future fuel. “You do have to pick a horse”, he said; retrofit concepts cannot later be steered from one target fuel to another. He foresees ammonia as a long-term option for container ships but expects it will be 2026 before MAN Energy Solutions starts sea trials with ammonia engines. So, his message is to start planning now to be ready when the technology is available.

In contrast to container ships, LR’s Global Bulk Carrier Segment Director Nikos Kakalis reported that, the pace of engine retrofits for alternative fuels in the dry bulk sector is expected to be slower. Although LR receives various questions and runs relevant joint development projects, the actual methanol and ammonia engine retrofit projects under discussion in the bulk carrier sector, are very few at the moment.

The techno-economic considerations in the bulk sector are significantly influenced by the sector’s tramping nature – particularly in the smaller sizes – and the uncertainty that this implies for any particular alternative fuel wider availability. At the larger end of the size spectrum on which LR’s report is based, this may not be such a large issue since these ships may be dedicated to specific trades, such as Australia to China or Japan.

Crew competence

Besides the engineering and economic considerations, Kakalis highlighted another important factor to consider when planning an engine retrofit: crew competence, in all ship types and especially in the bulk sector.

“The human factor is not just a couple of words on paper but the most important asset in shipping,” he said, so he advises bulk carrier operators to start thinking about their crews from now, well before bulk carrier newbuilding with alternative fuels or retrofits become a reality.

LR has a very good understanding of the human factor, he said, and “this needs to be taken care of.” This will require a re-think; additional awareness and training for existing crews before the engineering changes are made and perhaps additional competencies for future recruits so they can manage the more sophisticated fuel arrangements. “It's not only the engine [that will be upgraded] it's also to focus on the people that will operate the new systems,” he said.