The EU have set a target of reducing net greenhouse gas emissions by at least 55% by 2030 to help combat climate change and achieve climate neutrality by 2050.

The EU Emissions Trading Scheme and FuelEU Maritime can offer significant competitive advantage to owners and charterers that understand the incentives.

Exposure to carbon pricing may seem like a threat to some ship owners and charterers. The aim, after all, is to encourage a switch to green fuels that will likely be more expensive than fossil fuels, accompanied by costly changes to operations. But these incentives and penalties can also offer wide scope for profit to those that understand them fully.

The two EU carbon-pricing schemes that shipping will soon be subject to are a case in point. Carbon Dioxide (CO2) emissions from ships ≥5000GT in 2024 reported under the EU’s Monitoring, Reporting and Verification (MRV) system will also be included in the regional Emissions Trading Scheme (ETS). Those vessels in scope of the ETS will need to buy EU Allowances (EUA) to cover half of their greenhouse gas (GHG) emissions to and from EU, Norwegian and Icelandic (EEA) ports, and all emissions for intra-EEA voyages and while at berth at EEA ports. In 2025, 40% of the CO2 emissions from voyages and at berth stays in 2024 will be subject to the ETS, ramping up to 100% in 2027. Just as the ETS phase-in ends there is a financial double-hit for shipowners. In 2026, the MRV will also require the reporting of CH4 (Methane) and N2O (Nitrous Oxide) emissions from ships, with EUAs to be paid on 100% of the CO2 equivalent of those emissions, in addition to CO2, within the ETS from 2027.

The other mechanism is FuelEU Maritime, which will come into effect in 2025. The regulation sets targets for reducing the yearly average GHG intensity of the energy used by a ship (or, crucially, by a fleet or pool of ships). The required GHG intensity reduction starts small, at -2% in 2025 (compared to a 2020 baseline), reaching -6% in 2030 and -14.5% in 2035, through to -80% by 2050. A penalty or reward is then calculated based on the extent of under- or over-performance against the vessel or fleet’s target for the year, and the cost of low-carbon fuel that would have been needed to meet the target.

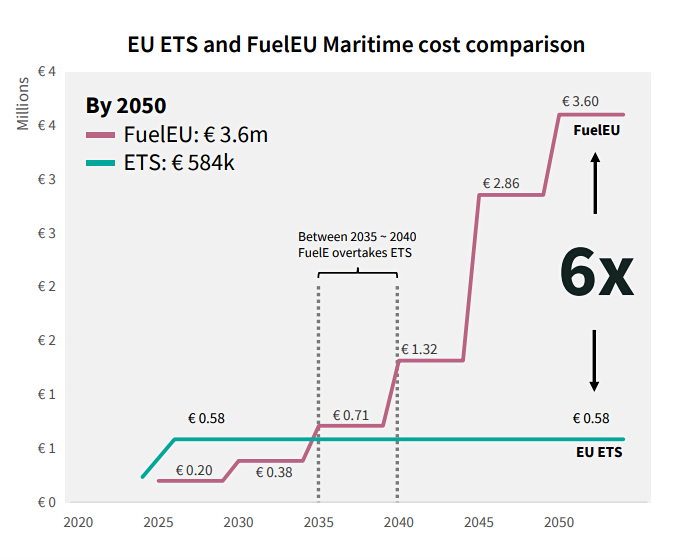

At first glance, it is easy to believe that the ETS, covering 100% of in-scope 2026 emissions by 2027, will have the bigger impact of the two mechanisms. FuelEU Maritime, by contrast, covers only a small percentage of emissions even as late as 2035. But analysis by Lloyd’s Register reveals that by that stage, the financial impact of FuelEU Maritime could already have overtaken the EU ETS. By 2050, the cost in FuelEU penalties could be six to eight times greater than the cost of buying EUAs.

“I think ETS is easier to understand,” says Luke Shu, Technical Manager - Maritime Commercial Markets at Lloyd’s Register. “If you emit one tonne of CO2, then you buy one allowance and you pay for that. Whereas FuelEU Maritime is entirely technical. The easiest way to see the impact is to model the compliance costs next to each other.”

Modelling compliance costs

The results are clear. For a large handy bulk carrier emitting 9,725 tonnes of CO2 equivalents (CO2e) on voyages to and from the EU, and 1,399 CO2e tonnes on intra-EU voyages or at berth in EU ports, the cost of EUAs in 2026 would be €0.58 million, while the FuelEU Maritime penalty would be €0.20 million if the ship keeps using the same fossil fuel. But by 2035, the FuelEU Maritime penalty would be €0.71 million, while the EUA price would stay similar assuming the carbon market is stable. Looking to 2050, the FuelEU Maritime penalty reaches €3.60 million, six times the EUA spend needed to cover emissions.

Although EU ETS foresees providing the right to shipping companies to pass on the financial cost under certain conditions to commercial operators or charterers, a significant amount of work remains to be done.

Most of the current commercial contracts are not yet ready to cover the multitude of scenarios of ‘who pays what’, so for both charterers and shipping companies starting with a sound understanding of regulatory impact and an understanding who owns operational exposure is fundamental prior to any updates to their commercial and risk management framework.

While EUA costs can be reduced by operating vessels more efficiently, exposure to FuelEU Maritime penalties can only be reduced significantly by changing fuel technologies. Further, Shu notes that FuelEU Maritime effectively rewards early adopters by decreasing the surplus for over-achieving compliance over time, while multiplying the penalty for failing to meet the target. Understanding the relative significance of each measure, and the optimal means and timing of compliance, is an important first step in successfully navigating carbon pricing.

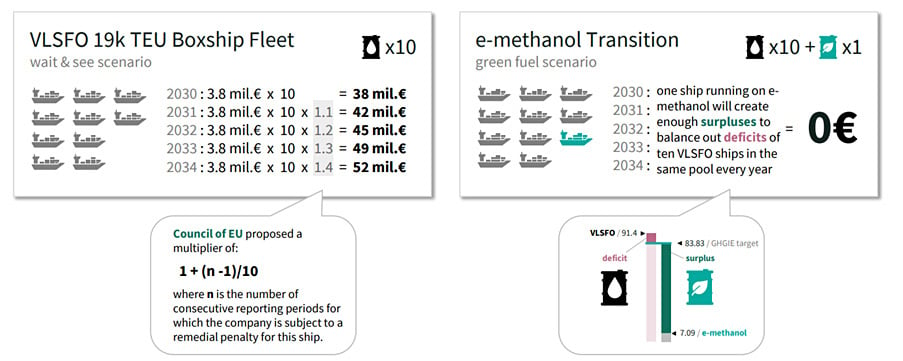

There are other opportunities too for those that grasp the full implications of the EU measures. One example is the potential to offset an entire fleet or pool’s penalties with just a few over-performing vessels. This opportunity arises from the EU’s decision to allow vessels with emissions verified by the same verifier to be pooled together. This can be done regardless of shipping companies, meaning it applies to the company’s fleets or to pools of vessels owned/chartered by several companies.

The ability to pool emissions penalties and surpluses has important consequences. For example, a pool of ten boxships could avoid around €277 million in FuelEU Maritime penalties in five years (2030-2034) if they are joined by a single vessel fuelled with e-methanol. That saving far outweighs the likely cost of building the methanol-fuelled containership.

The pooling option in FuelEU Maritime means that companies investing in a zero-emission capable ship would be in a very strong bargaining position when offering to pool with other non-compliant vessels. However, depending on the type of charter party agreement the vessels were under, and especially where charterers are responsible for buying the fuel, care will be needed. The regulation does not define whether it is the owner or charterer who owns the surplus associated with a vessel, meaning that parties entering into such arrangements will need to be sure that they understand the implications to maximise their advantage.

Knowledge is power

“Whoever has more knowledge in such a negotiation will win the battle,” says Shu. “If you are an owner without that knowledge, you may just think that a long-term charter is good. But if you sign the contract without looking into all the clauses, you may find that all the FuelEU Maritime compliance surpluses go to the charterer.”

The pooling elements of the FuelEU Maritime regulation have yet to be finalised, and some of these potential opportunities and challenges are likely to change once the draft is settled. But they highlight some of the new commercial considerations that are likely to come into play as carbon pricing becomes a reality for both ship owners and charterers.

For operators and charterers looking to develop their response to carbon pricing and other market-based measures, Lloyd’s Register’s Advisory Team can offer expert support, leveraging its industry know-how and regulatory insight to identify cost-effective compliance solutions and commercial opportunities.

Contact fitfor55@lr.org to learn more or arrange a conversation.