Draft regulations approved by the IMO at the recent Marine Environment Protection Committee (MEPC) 83rd session raise a question for the maritime sector – will there soon be two similar and overlapping sets of regulation: the International Maritime Organisation’s Net-Zero Framework (IMONZF), and the EU’s FuelEU Maritime (FuelEU)?

The simple answer is ‘Yes’, assuming the IMONZF enters force in 2027 and controls the greenhouse gas (GHG) intensity of international shipping’s energy use from 2028 and as it currently stands FuelEU will remain in force.

From that point, any ship of 5,000 GT or more (with certain exceptions) calling at EU ports will be regulated twice, to comply with both the IMONZF and FuelEU.

However, FuelEU has a potential self-destruct mechanism, which could revert two regimes back to one. Recital 69 and Article 30 of the FuelEU regulation state that a global approach by the IMO to limit GHG ship intensity would be preferable and more effective due to its broader scope.

Accordingly, the European Commission (EC) will, if the IMONZF is adopted, conduct a review and present a report to the European Parliament and to the Council of the EU as per FuelEU Article 30. However, the specifics of this remain unclear.

Inconsistent alignment

These regulations are similar in ambition and scope but there are also differences. The IMONZF lacks some of the detail of FuelEU, including establishing the GHG default emissions factors of different fuels.

FuelEU also mandates Onshore Power Supply (OPS) but this is not required under IMONZF. FuelEU further incentivises the uptake of Renewable Fuels of Non-Biological Origin (RFNBOs), and in the future may mandate a portion of energy use from these fuels, which IMONZF does not.

The IMONZF so far only has reduction targets confirmed through to 2035 with a line in the sand for 2040, while FuelEU has a known timetable to 2050. These points of difference may align as both regulations move to an implementation phase, but we don’t yet have that certainty. There are other inconsistencies, such as the use of prearranged pools to buy and sell surplus compliance under FuelEU, which are summarised in the box below.

Risks to regulatory harmony

For the IMONZF to be effective it must be both comprehensive and enforceable.

While there is broad support for action under the IMONZF, can intention be turned into implementation? Everything remains speculative until there is final agreement. Delays in adoption will delay global decarbonisation measures.

If, once published, the guidance and methodologies underpinning the IMONZF diverge too much from FuelEU then this could present a problem to removing FuelEU.

Similarly, if FuelEU and the IMONZF do have to coexist, there may be some way to report both but only pay once and so avoid double payments, if not double monitoring.

The regulations in numbers

LR has analysed both regulations, comparing the potential GHG emissions savings and impact for a hypothetical ship operating exclusively in EU waters, allowing you to draw your own conclusions about whether FuelEU and the IMONZF will coexist for the long run or whether FuelEU could eventually be withdrawn.

In these models, the IMONZF is assumed to continue on the same path to 2050, with the RU price remaining set at today’s rates and an exchange rate of 0.87 USD to the Euro.

For both regulatory frameworks it was assumed that the ship would pay the greatest penalties i.e. Remedial Units under the IMONZF and the penalties set by FuelEU to paint a picture around the ‘worst case’ scenario for both.

For FuelEU, the analysis assumes the ship will not pay additional penalties for consecutive compliance deficits to make the results comparable and it is acknowledged a ship not complying in consecutive years would pay increasingly higher penalties.

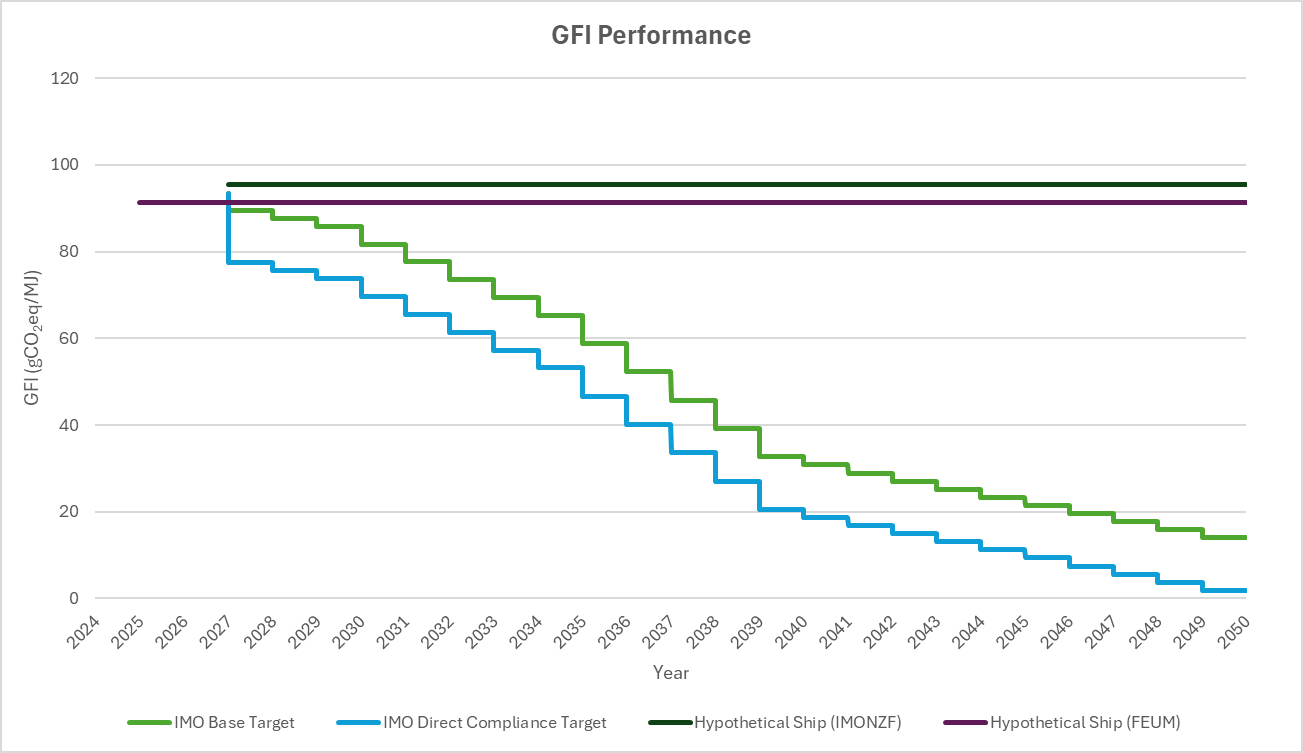

If the hypothetical ship assessed uses 10,000 tonnes of VLSFO and 1,000 tonnes of ULSFO each year between 2025 and 2050, it has an annual GFI of 95.48 gCO2eq/MJ under IMONZF and 91.33 gCO2eq/MJ under FuelEU compared to reference values of 93.3 gCO2eq/MJ under IMONZF and 91.16 gCO2eq/MJ for FuelEU.

In the graph above, this hypothetical ship will always have a GFI greater than targets. Under these scenarios, the FuelEU target is less stringent than both the IMONZF base and direct compliance cases.

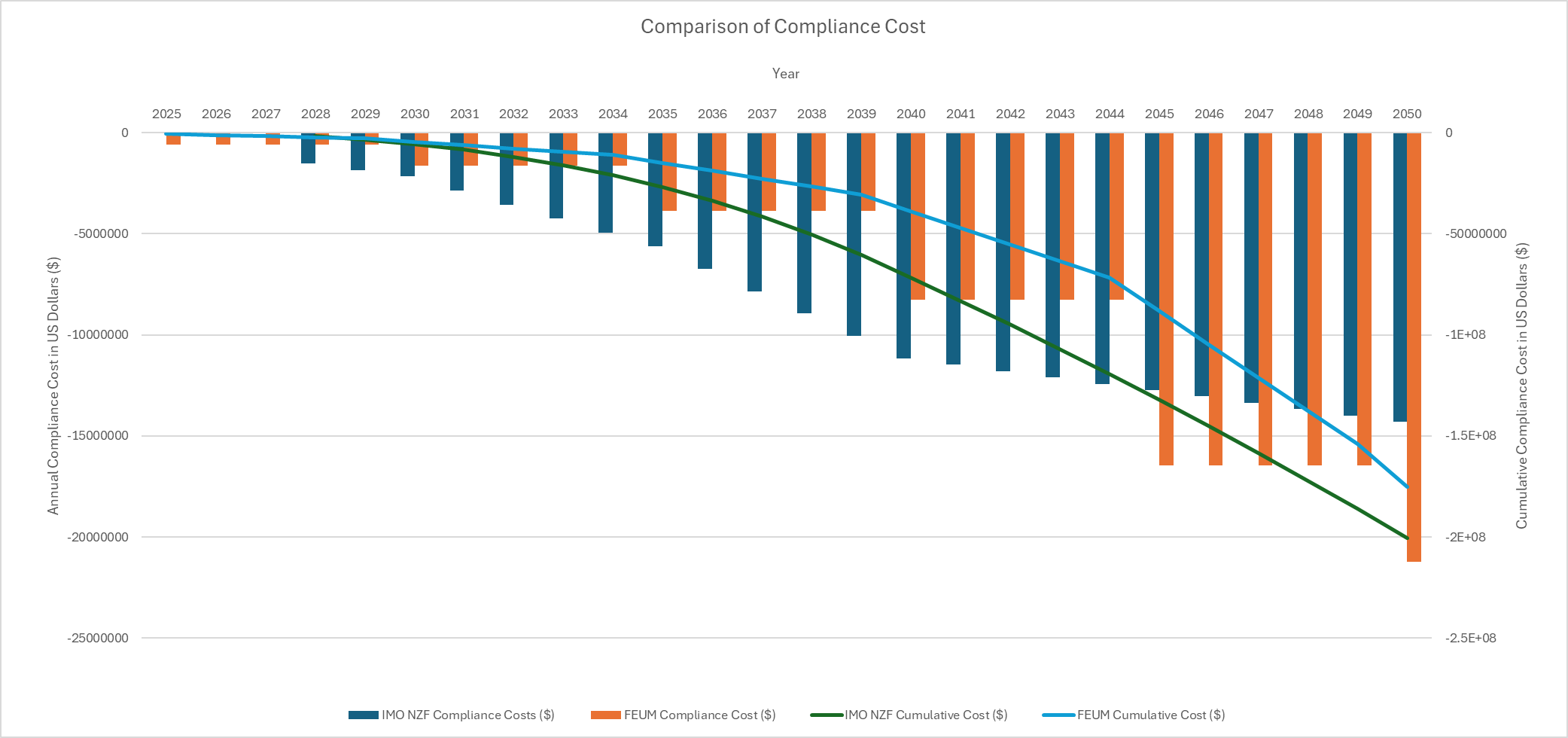

Under both regimes, this hypothetical ship will face increasing financial penalties, as sketched below, with the blue and green lines showing cumulative costs.

This analysis shows the IMONZF setting greater annual financial penalties up to 2045, with FuelEU then taking over and setting greater penalties from 2045 to 2050. Overall, the cumulative penalties would be greater under IMONZF.

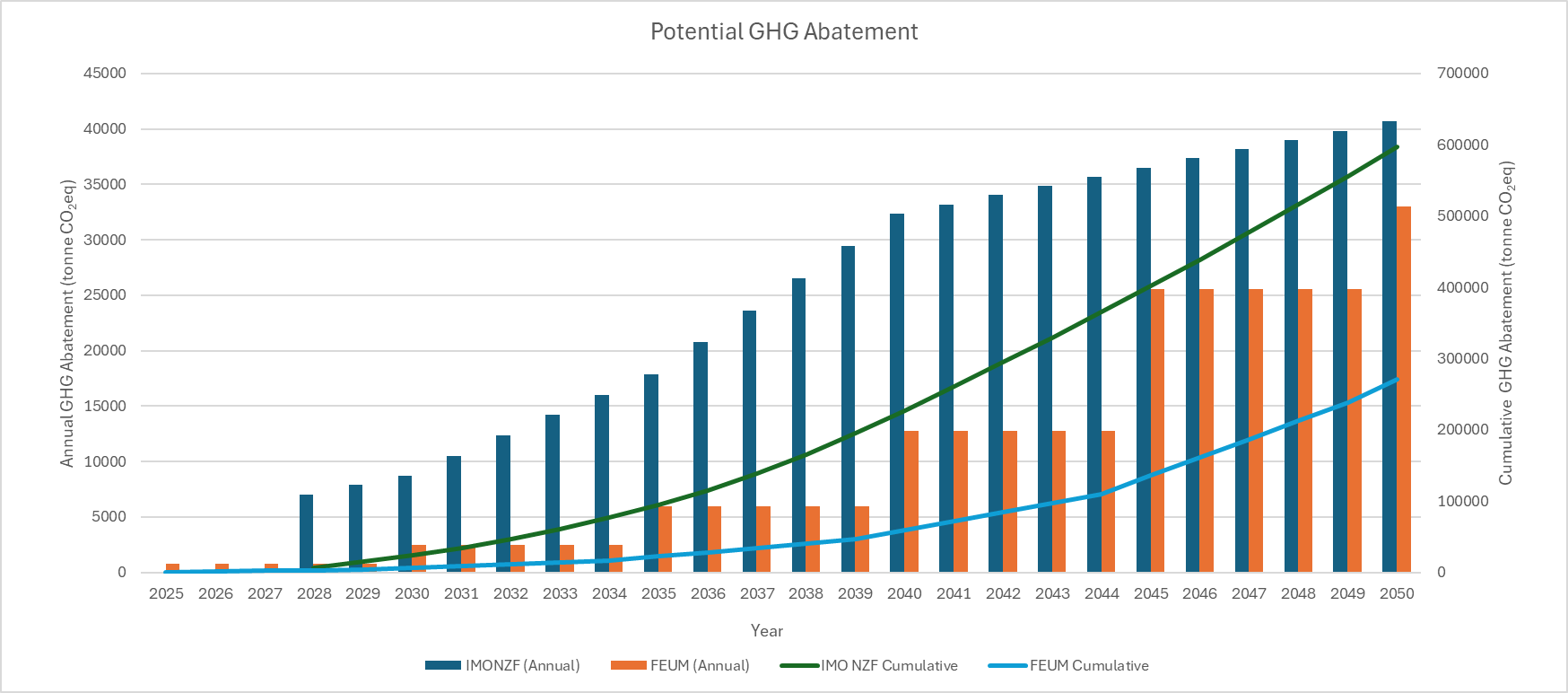

That’s the financial side, but it’s also worth comparing the relative GHG abatement possible under the two schemes as this is one of the criteria under FuelEU recital 69, that any global scheme would need to satisfy the EU’s overall decarbonisation goals.

Here the hypothetical ship’s energy consumption remains constant but is assumed to use energy sources allowing it to always meet both the IMONZF direct compliance target and the FuelEU target.

CO2-equivalent abated is greater both annually and cumulatively under the IMONZF in this case. It could be concluded that the IMONZF is more ‘stringent’ than FuelEU by removing more CO2-equivalent overall.

These models track a hypothetical ship under two scenarios – one where it fails to adapt and incurs penalties, and another where it adapts perfectly to show how much CO2-equivalent was abated.

In the real world the picture will be more complex because neither scenario factors in the financial costs and savings of making ships more efficient, of transitioning to low or zero-carbon fuels, or trading compliance surpluses.

For a model that meets your specific needs, talk to LR Advisory, where more complex but relevant factors, such as the potential costs of retrofits, new build, and the availability of new fuels, are all considered for your fleet.

Feature |

FuelEU Maritime |

IMO Net-Zero Framework (as it currently is understood – this may change) |

|

Scope |

Applies to ships calling at EU ports, regardless of flag. |

Applies to all international shipping. |

|

Vessel size and type |

All ships of 5,000 gross tonnage (GT) and above for transporting passengers or commercial cargo. Does not apply to warships, naval auxiliaries, fish-catching or fish-processing ships, wooden ships of a primitive build, ships not propelled by mechanical means, or ships owned or operated by a government and used only for non-commercial purposes. |

All ships of 5,000 gross tonnage (GT) and above. Military and government non-commercial vessels, and domestic ships operating within waters of their flag state are excepted, as are FPSOs, FSUs, platforms, ships not propelled by mechanical means, and semi-submersible vessels. |

|

Exemptions |

Certain geographic exemptions (voyages to / from outermost regions), route exemptions (specific routes and ships that serve remote or insular communities) are applicable until 2030. |

None. |

|

Start Date |

2025. |

Draft approved in 2025 (MEPC 83) – anticipated start 2028 (if adopted). |

|

GHG Metric |

Well-to-wake GHG intensity (gCO₂e/MJ). |

Well-to-wake GHG intensity (gCO₂e/MJ. |

|

Gases Covered |

CO₂, CH₄, N₂O (100-year GWP) – referring to IPCC AR4 report GWP values. |

CO₂, CH₄, N₂O (100-year GWP) – referring to IPCC AR5 report GWP values. |

|

Compliance System |

Single tightening target. |

Two-tier system: Base and Direct Compliance targets, with both becoming progressively more stringent. |

|

Penalties |

Financial penalties for non-compliance. |

Financial penalty for Tier 1 compliance deficit priced at $100/tonne CO2eq, and Tier 2 Remedial Units (RUs) priced at $380/tonne CO₂e which will set the ceiling price for alternative compliance methods for balancing Tier 2 deficit. |

|

Fuel Certification |

Yes – following criterial outlined in the Renewable Energy Directive. |

Yes - IMO to publish list of accepted Sustainable Fuel Certification Schemes by 2027. |

|

Sustainable Fuels |

Incentivises low-GHG fuels; strict sustainability criteria. |

More to follow in further development of the IMO’s LCA Guidelines regarding sustainability criteria for fuels. |

|

Methane and Nitrous Oxide Slip measurements |

Allows measured methane slip reporting instead of default factors, if the measurements comply with recognised international standards e.g., ISO or IMO guidelines. Currently only guidance available is from IMO MEPC.402(83) but EC must confirm if this can be used. |

Adopted MEPC.402(83) guidelines for test-bed and onboard measurements of methane (CH4) and/or nitrous oxide (N2O) emissions from marine diesel engines which are assumed to support the IMONZF. |

|

Banking & Borrowing |

Allowed. |

Ability to bank surplus compliance but no borrowing from a future year’s compliance. |

|

Pooling |

Yes, ships can pool compliance between or within fleets. |

Yes, but not referred to as pooling, allowing surpluses to be transferred between over and under compliant ships. Arguably a broader and more flexible approach than FuelEU pooling although can only be transferred to ships in Tier 2 deficit. |

|

Remedial Units (RUs) |

Not applicable. |

Yes - Tier 1 (Base) and Tier 2 (Direct) RUs priced at differing $/tonne CO₂e. |