The recent upturn in newbuilding activity, after several depressed years, came with the progressive recovery of the container sector from Q4 2020 onwards, which has proved a ‘saving grace’ for the shipbuilding industry. As market rates started climbing and lines saw their competitors ordering new vessels, they quickly followed suit. That’s the primary reason why most top-tier yards are full today, certainly in leading shipbuilding nations Korea and China.

Forthcoming emission regulations have also contributed to owners deciding to order new ships, as well as in the liner sector the first wave of 14,000 – 15,000 TEU megaships now reaching a crucial mid-life decision stage, often being replaced by today’s largest-size vessels of 22,000 – 24,000 TEU.

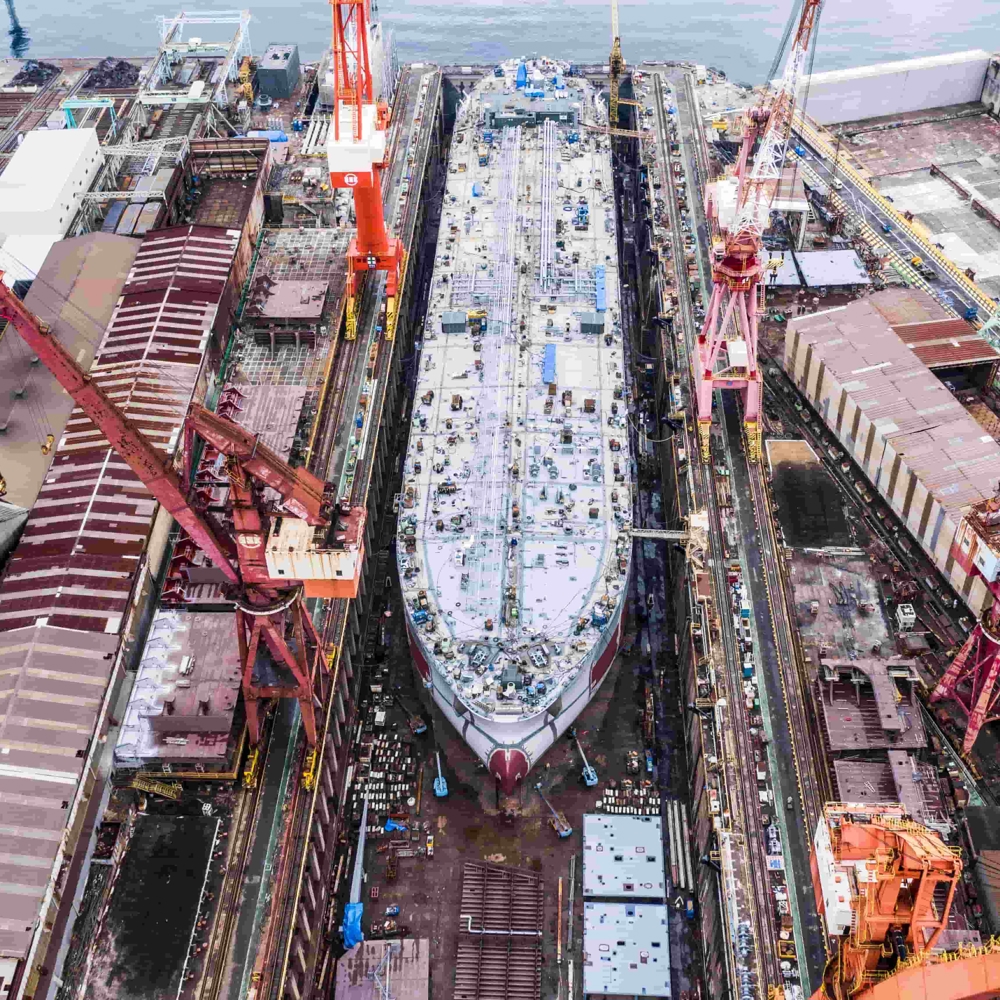

Another contributing factor is that major yards such as Hudong-Zhonghua in China are beginning to handle Qatar Gas’s mega-order for liquefied gas vessels to replace its existing LNG fleet, and Jiangnan Shipyard and DSIC are opening up to the market for LNG carrier builds. The sheer size of these giant gas ships, as well as of their container-carrying counterparts, takes up much available yard space, dockside berths and materials.

The end result has been that newbuilding slots across the major yards have filled up incredibly quickly. Owners are really going to struggle to find slots for large ships to be delivered by 2024, perhaps even Q1 2025, in top-tier yards.

The competition for yard space has also shifted the balance of power in the yard-owner relationship and driven up newbuilding prices, as have rising costs of steel, meaning vessels in most sectors are now about 30% more expensive than they were 12 to 18 months ago.

All of which raises a problem for smaller vessels with shorter build times. Owners are facing an economic challenge, namely: why order a vessel now that will be expensive and not built for several years? This in turn opens up the risk of stranded assets if the impact of environmental regulations are not factored into design and operational decisions.

Granted, some smaller shipbuilders do still have delivery slots available for late 2023 or early 2024, and capacity remains in the Japanese yards. But choosing the right design is paramount. Certainly, there will be designs that are regulatorily compliant now, but could be behind the future development curve, particularly in areas such as the integration of advanced technologies and future fuel-ready designs.

Regarding the choice of alternative fuels to meet tightening IMO decarbonisation goals, LNG offers a solution that is ‘here and now’ with a fast-developing infrastructure of bunker supplies. Major and secondary yards in all three top shipbuilding nations can certainly offer ships with LNG as an option.

There’s also considerable interest in the use of methanol, ammonia and biofuels, and a lot of the concerns and questions around these fuels are the same ones that were being asked about LNG five years ago. These include availability or commercial considerations of the vessel’s operating profile and who is going to pay for the extra expense involved, owner, operator or charterer.

That’s why this year and 2023 promise to be very interesting in terms of the fuel options chosen by owners for their newbuildings. Alternative fuel ‘ready’ notations are already available in the marketplace, providing an assurance framework extending from the risk mitigation at the design stage, right up to equipment installation. But these fuels still have issues over safe handling, fuel management, systems compatibility and emissions that need to be considered, meaning that the commercial and supply chain availability of the equipment remains further away.

In recent years, LR has progressively extended out our low flash point fuel (LFPF) Class Notations beyond the originally intended methane, to apply to other petrochemical gases, alcohols, and then across to hydrogen-based fuels including ammonia.

We have procedures that look at the core principles of the fluid itself as well as the safety of the engineering systems that consume, process and handle that particular fluid, and the risks associated with the entire end-to-end process. Essentially what we’re saying is: you can burn an alternative fuel as long as the level of safety – the control of the risk – is equivalent to that of burning oil fuels or methane.

Integration of smart systems into ship design is another trend to watch, with many of the leading yards installing integrated software systems and equipment for data extraction and analysis – either proprietary or bought-in – to their ship designs. The key factor here is the owner must understand what the desired outcome of the data or system is beforehand.

Elsewhere, the most important applications of automation in today’s shipbuilding sector remain the robotic cutting and welding processes. We still have core issues in metal fabrication where small lapses in quality can lead to major defects. Leading shipyards continue to invest hugely in production management – such as weld control, dimensional accuracy, coating application, and equipment installation – which are of the same critical importance as they have always been.

Roger has spent the last three years growing the technical advisory side of LR’s business in China, after having previously worked first as a surveyor and then as an account manager for LR.