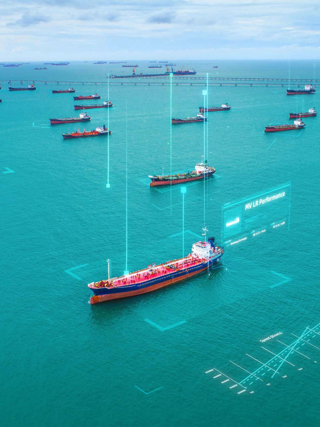

Our maritime performance services help you to stay cost effective and profitable while transitioning your environmental, social, and corporate governance (ESG) strategy.

Market volatility and uncertainty on the regulatory development front are dominating the current landscape for bulk carrier shipping.

The market fundamentals in terms of tonnage supply and demand remain healthy for dry bulk shipping. According to Clarksons, commodities trade is estimated to grow at appoximately 1% per annum over the next three years. Rising energy prices are leading countries to re-optimise their energy mix, resulting in increased demand for coal which is expected to remain solid over the next five years. On the other hand, the Ukraine / Russia crisis has led to major disruptions in specific trades, resulting in increased tonne-miles for both grain and coal transportation, and the uncertainty this has created is expected to last for a few years ahead.

The talk of the town, however, is different. Decarbonisation targets and gradual implementation of associated regulations at international and national levels have already initiated a change. This is rather an energy transition, to which we all need to adapt in dry bulk shipping if we want to remain competitive, let alone in business.

To this end, energy transition strategies need to be developed so that companies define their strategic approach, understand where they are now and where they need to go, ensure compliance, and develop a transition roadmap without placing excessive demands on capex, operations, and shareholder returns.

Such an exercise needs to consider alternative fuels and energy efficiency technologies both at vessel and fleet-wide levels, targeting optimal decision making. Of course, this is far from trivial due to limited techno-economic data and experience for specific technologies as well as limited current bunkering infrastructure globally for alternative fuels. The questions on what fuels and tech to select (technical uncertainty), their availability (supply chain uncertainty) and their affordability (commercial uncertainty), are among the most important commercial, technical, and environmental complexities we need to manage. Shipping companies must consider the necessity and opportunities from the development of energy transition strategies at the right time, based on their corporate profiles and vision.

Regulatory uncertainty remains at various levels. This November, the newly adopted IMO regulations on EEXI and CII are coming into force, focusing on vessel performance and the technologies installed on-board, as well as how vessels are operated in terms of energy efficiency.

But how EEXI and CII regulations will develop beyond 2026 is a key question. Will regulation be stricter and if yes, how much?

For example, if a bulk carrier implements an Engine Power Limitation (EPL) of 40% to comply with current requirements and then faced much stricter EEXI requirements beyond 2026 such that the vessel becomes too difficult to operate, then scrapping would become the only commercially viable option. But what if, however, we have a bullish market? How would charterers, owners and managers handle that?

According to current EU-MRV and IMO-DCS data, almost 50% of the current dry bulk fleet will be in a challenging situation in 2026. Detailed implementation guidelines and non-compliance implications after corrective measures have been taken have not been provided by the IMO yet. Correction factors for port waiting time and for self-unloading vessels are not in place at the moment. With 65% of the global bulk carrier fleet being engaged in tramp shipping, the possibilities for vessel penalization simply from these two factors are high.

The market, however, moves and does not wait. Shipping needs to continue its main task: to continue transporting 90% of global goods in a safe, effective, and environmentally friendly manner. It is, therefore, imperative that uncertainties are demystified so that dry bulk ship-owners and operators have a better understanding of where we are heading.

In anticipation of the MEPC 78, taking place this week, do we envisage to have all these fully clarified? Most probably not; but at least we expect that some of these issues will start to be put into perspective.

Use our interactive CII calculator to review your vessel’s carbon intensity indicator rating, based on the latest IMO guidelines. You can also trial different scenarios to assess the impact on compliance status.