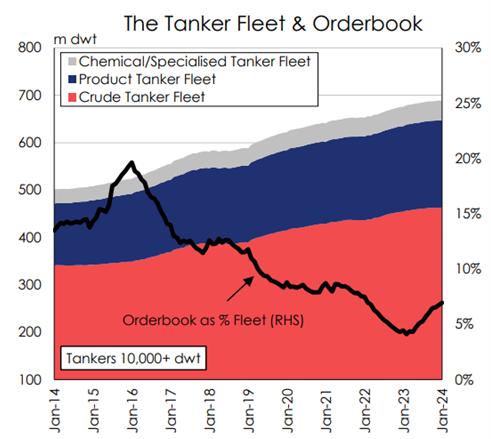

While the world continues to embark upon its energy transition journey, tanker owners are still assessing their options. Tankers of many different types will be required to transport the world’s energy for at least another two decades, but owners of these assets are mostly holding back on new investments with the orderbook far lower than it was a decade ago.

Although I can well understand this investment reticence, I don’t believe it makes sense. The backdrop is perfectly clear. Peak oil production is not expected before the end of this decade and tankers of various types will be required to transport crude oil, refined products, and petrochemicals for many years to come. At least one more generation of crude oil tankers will be needed.

As we have seen with product tankers, the shift to new cargoes, as the demand of products increases, will be heavily impacted by the need for global industry decarbonisation. Ammonia and methanol vessels will be required to support the need for these alternative fuels.

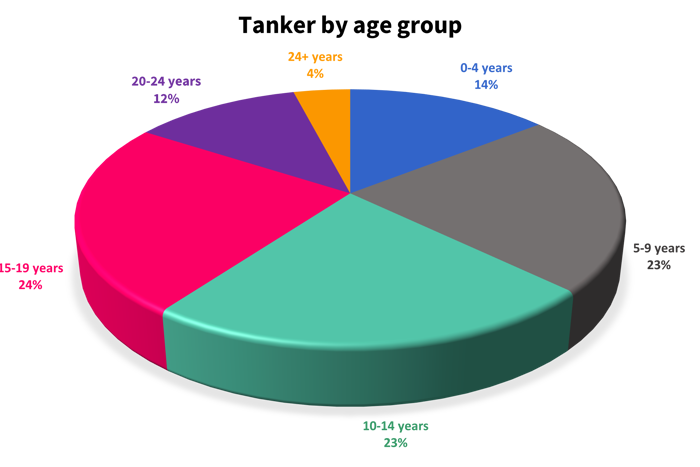

We have seen a surge in product tanker contracts over the last year. However, in relative terms, product carriers on order still represent only about 12% of the fleet according to GT (Gross Tonnage) and 9% of the fleet according to number of vessels, significantly below the median level. Moreover, almost 40% of the fleet is more than 15 years old.

There has been a series of VLCC (Very Large Crude Carriers) orders placed in the early weeks of the year. Even so, tankers on order in this class represent only about 6% of the fleet, a long-time low that I don’t believe has been equalled so far this century. And in this sector, more than 250 vessels or about one third of the fleet are older than 15 years.

| Figure 1 (Source: Clarksons)

Supply lags demand

In terms of tanker demand, expanding energy requirements in rapidly growing populous regions, such as India and Africa, are underpinning the development of new tanker trades. In the medium term, economic growth in these regions will spur oil import demand and underpin nascent tanker trades.

New trade flows will add to tonne-mile demand which is already rising fast. For example, the switch in Russian oil supplies to Europe, which are now destined for markets in India and China. Europe, meanwhile, has turned to the middle East and the United States for more crude oil, another boost to tonne-miles.

At this stage, we have seen the first signals of the influence from the crisis in the Red Sea and more tankers are choosing to route vessels around the Cape of Good Hope. It is uncertain how long this will last, however, the current situation is absorbing a significant volume of the extra tanker capacity.

In the longer term, meanwhile, a build-up of refining capacity closer to oil producing regions will mean more shipments of long-haul products. This will drive tonne-mile demand for clean tankers, chemical carriers, and gas ships. Shipowners in these sectors have already enjoyed a bull run for months but these markets are likely to remain both robust and rewarding.

Fossil fuel reliance

So why are tanker owners holding back on fleet renewal? There are several factors. One is concern over the impact of the energy transition and how quickly this could change market fundamentals. But the global economy is geared to energy from oil, fossil gases, and petrochemicals, increasing volumes of which require transport by sea. Tankers will be needed for at least two more decades, probably longer.

But tanker owners face a unique conundrum. A new vessel ordered today would not be delivered before 2026. It would be nearly mid-century by the time it reached its twilight years. Would the tanker still be needed by then?

If you ask me that question today, I would answer with a definitive yes, but I might well be hedging my bets if you ask me the same question in ten years’ time.

More immediately, owners are holding back because of uncertainty over future marine fuels and the sustainability of tanker operations generally. In the short run, they are also put off by higher tanker prices.

Many owners are saying that they will not order at today’s prices, but I believe they are mistaken if they think prices are likely to ease in the months ahead. In fact, I think quite the opposite.

Builders will capitalise on strong charter markets and their existing robust orderbooks. Why would prices soften if there is pent-up demand for new tonnage and shipyards, in practical terms, are full?

VLCC prices have risen from around $90m at the beginning of the decade to around $120m in China and an extra $10m in South Korea today. But new ship prices have risen across the board. There are some predictions that prices will fall by next year, however, the urgent need for new vessels in all sectors brings the demand for slots to a high level. At the same time, there is a reluctance from newbuilding countries to open additional slots by reopening inactivated yards, to avoid what happened in the past with yard bankruptcies. This will be a key factor to keep prices at high levels.

Strategic planning

Of course, we do not have a crystal ball and, as in any market, there is significant uncertainty. As the tanker team, we see a growing number of requests from owners for support in strategic planning. They are looking for feasibility studies on options such as life extension or replacement; the installation of energy saving devices; or engine retrofits.

However, the economics are complicated because many older tankers may be only marginal upgrade candidates. This applies to the majority of ships that have passed their third special survey. Payback periods for complex retrofits could well be uncertain, or simply too long.

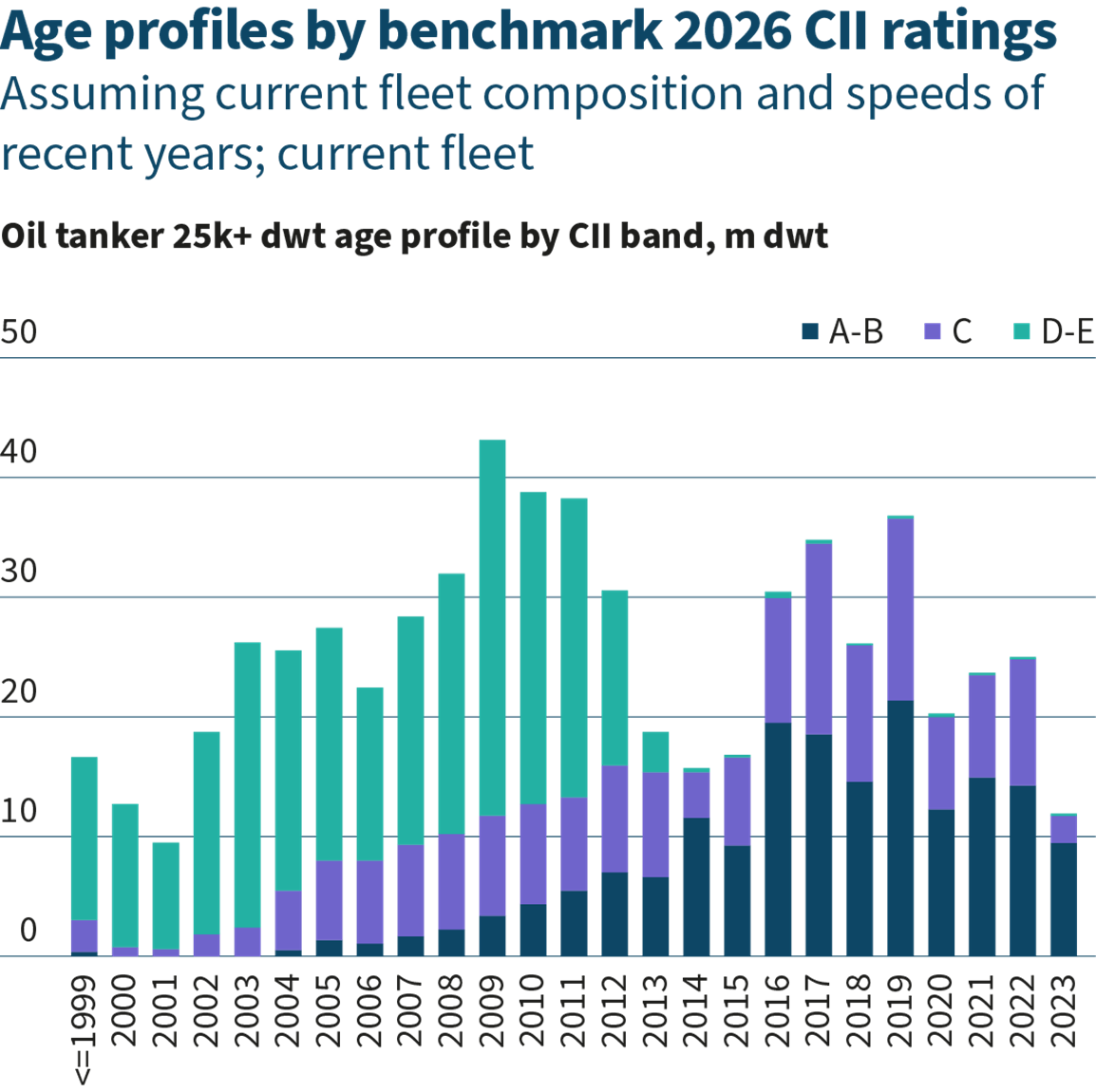

But investing in older vessel upgrades may no longer be a matter of choice. If tankers are to pass charterers’ increasingly rigorous vetting procedures, they must have carbon intensity indicator (CII) ratings of A to C. I expect most tankers older than ten years will almost certainly fall into categories D or E and therefore require remedial action.

Most tankers older than ten years will almost certainly fall into categories D or E (of CII) and therefore require remedial action.

Regulatory impact

Meanwhile, new carbon regulations will also have an impact. The EU Emissions Trading System (ETS), in place since the start of the year, will impose emissions-related penalties on shipowners trading to, from, or within the European Economic Area, from September 2025.

Running in parallel, the bloc’s FuelEU Maritime will have an even greater impact because it measures emissions on a well-to-wake basis, rather than a tank-to-wake setup. This has a dramatic impact on the carbon intensity of some fuels, thereby increasing penalties accordingly.

Careful analysis of retrofit options is necessary and expensive engine modifications are often only viable for ships with at least ten more years of likely operation. They are also more likely to offer a favourable option on larger and/or more sophisticated vessels.

Considering the CII ratings profile, tankers older than 10 years will need to improve their efficiency soon in order to keep CII ratings from A-C.

| Figure 3

Consider ESDs

There are plenty of other strategies which prudent tanker owners should consider. For example, a combination of energy saving devices could make perfect sense for a mid-life products tanker.

Options could include mewis ducts, pods, rudder bulbs, and advanced hull coating systems. Wind-assisted propulsion systems are a promising technology that has piqued the interest of shipbuilders and owners. Wind sail technology is developing fast and can maximise its efficiency with the adaptation of voyage optimisation. There has been a slow penetration of these technologies into the tanker sector so far, with more installations scheduled for later this year.